Exemption Certificate Format

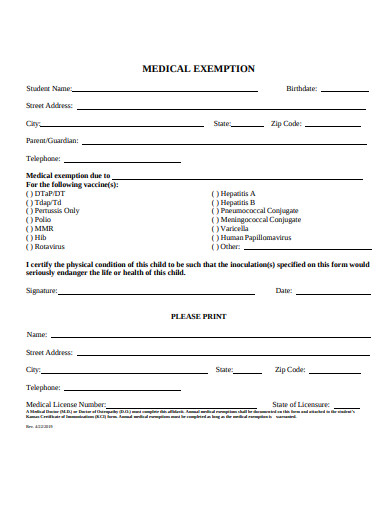

Sales use tourism and motor vehicle rental tax name of business or institution claiming exemption purchaser telephone number street address city state zip code authorized signature name please print title.

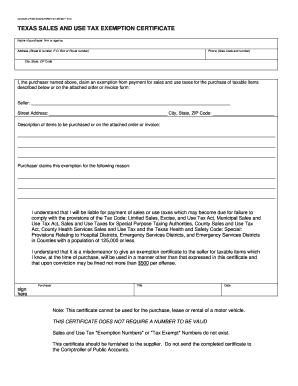

Exemption certificate format. This is a blanket certificate unless one of the boxes below is checked. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable. Texas sales and use tax exemption certification. A choose one time purchase and include the invoice number this certificate covers.

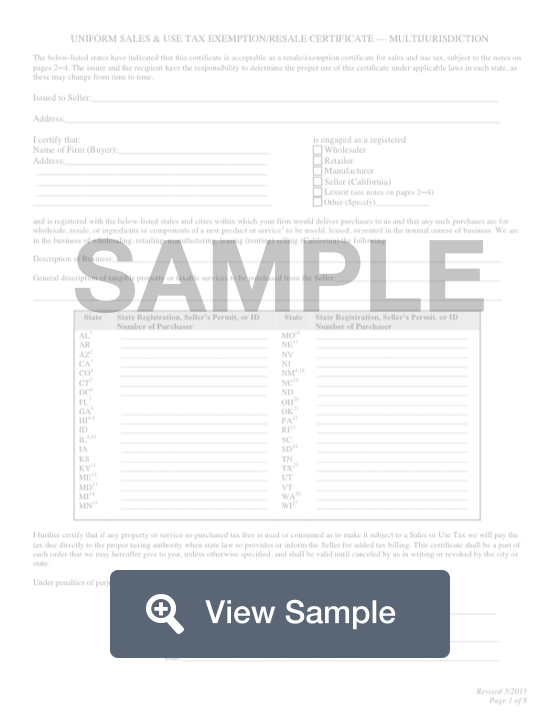

1 identification of purchaser and seller. Do not return this form to the pa department of revenue. Name of purchaser firm or agency address street number po. 2 a statement that the certificate is for a single purchase or is a blanket certificate covering future sales.

Format from the purchaser or resale or exemption certificates or other written evidence of exemption authorized by another state or country. Certificate for exempt purchases of meals or lodging by exempt entities fillable 0105. 1118 utah state tax commission 210 n 1950 w salt lake city ut 84137. The purchaser will be held liable for any tax and interest and possibly civil and criminal penalties imposed by the member state if.

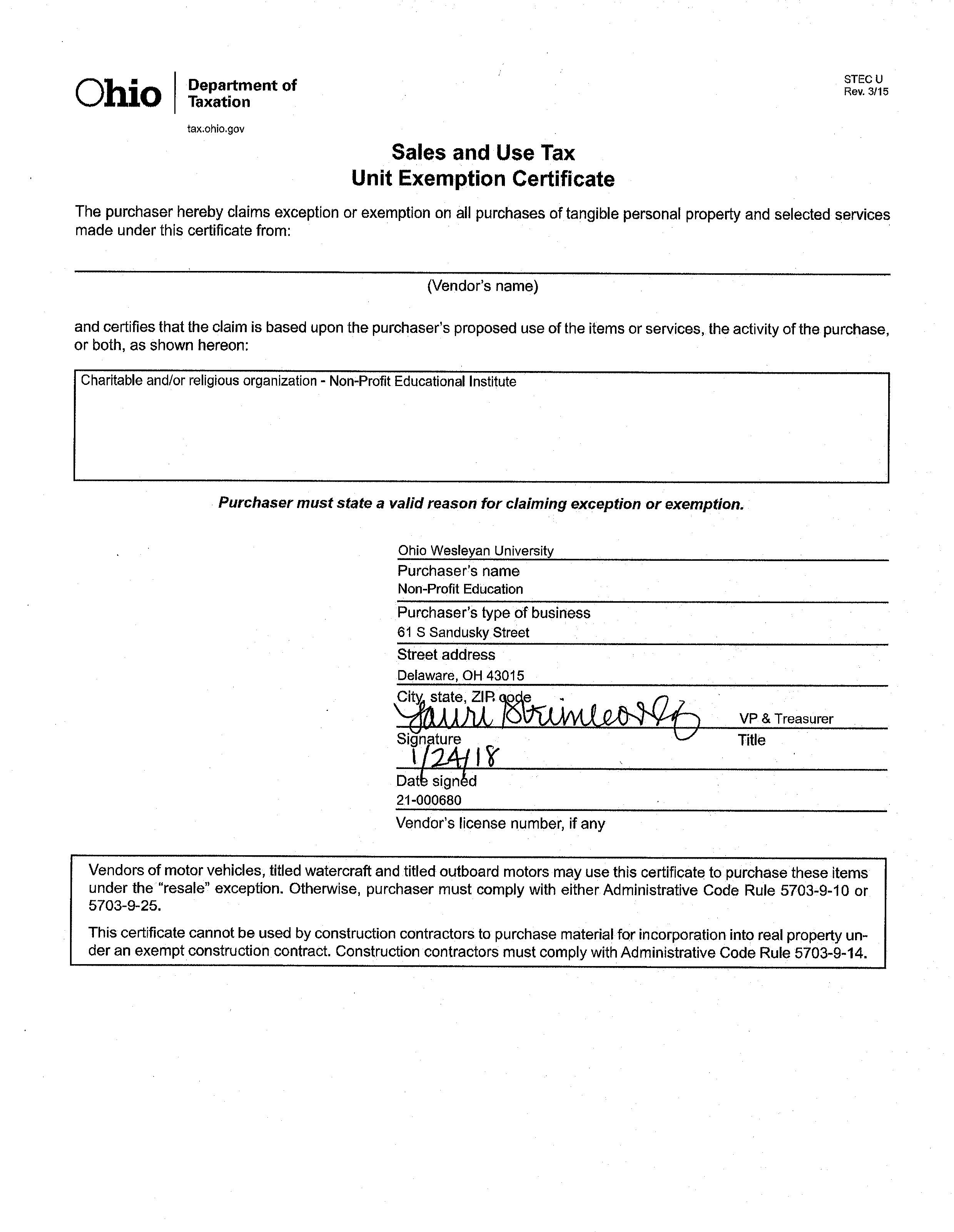

Place a check in the box that describes how you will use this certificate. The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies. If this certificate is not completed you must charge sales tax. The exemption certificate must include all the following.

Form st3 certificate of exemption purchaser. Exemption certificates of other states or countries are not valid to claim exemption from new york state and local sales and use tax. As a purchaser you must use the correct exemption certificate and complete it properly before giving it to the seller. Provide this exemption certificate or the data elements required on the form to a state that would otherwise be due tax on this sale.

Complete this certificate and give it to the seller. Box or route number phone area code and number city state zip code. Certificate for machinery equipment materials tools and fuel used by an aircraft manufacturer operating an aircraft manufacturing facility. 1because form 8871 must be filed electronically a paper version of form 8871 may not be filed and is not available for download.

2because form 990 n must be filed electronically a paper version may not be filed and is not available for download. This form may be used in conjunction with form rev 1715 exempt organization declaration of sales tax exemption when a purchase of 200 or more is made by an organization which is registered with the pa department of revenue as an exempt organization. For an exempt sale certificate to be fully completed it must include.