Social Security Benefits Worksheet

The worksheet on the back page shows how to estimate the social security monthly retirement benefit you would be eligible for at age 62 if you were born in 1957.

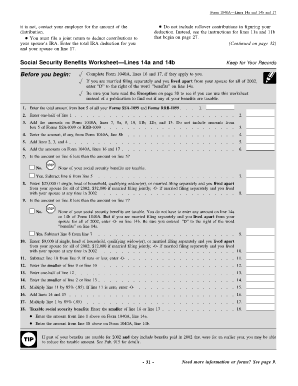

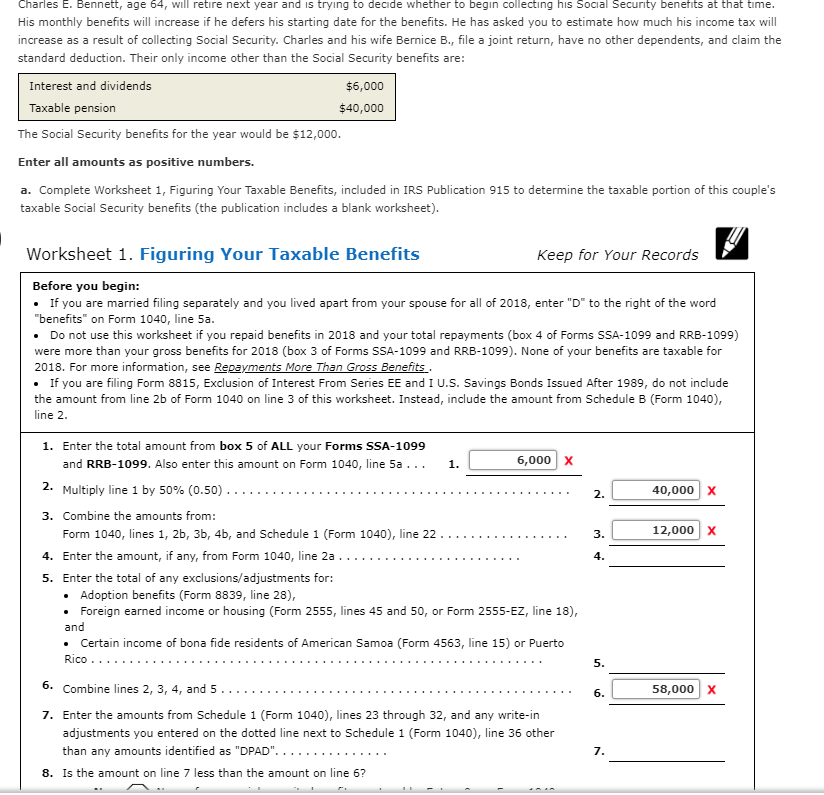

Social security benefits worksheet. Keep for your records. Social security benefits worksheetlines 5a and 5b. Enter the amount of the 2019 ssi monthly benefit a. Enter the total amount from line a above on form 1040 or 1040 sr line 5a and enter 0 on form 1040 or 1040 sr line 5b.

If you are married filing separately and you lived apart from your spouse for all of 2018 enter d to. If none of your benefits are taxable but you must otherwise file a tax return do the following. However the irs helps tax payers by offering software and a worksheet to calculate social security tax liability. If married filing separately and taxpayer lived apart from his or her spouse for the entire tax year enter d to the right of.

Social security benefits worksheet 2018 before filling out this worksheet. Calculating 2020 current year ssi amount from a prior year benefit. Once you calculate the amount of your taxable social security income you will need to enter that amount on your income tax form. 915 and social security benefits in your 2019 federal income tax return instructions.

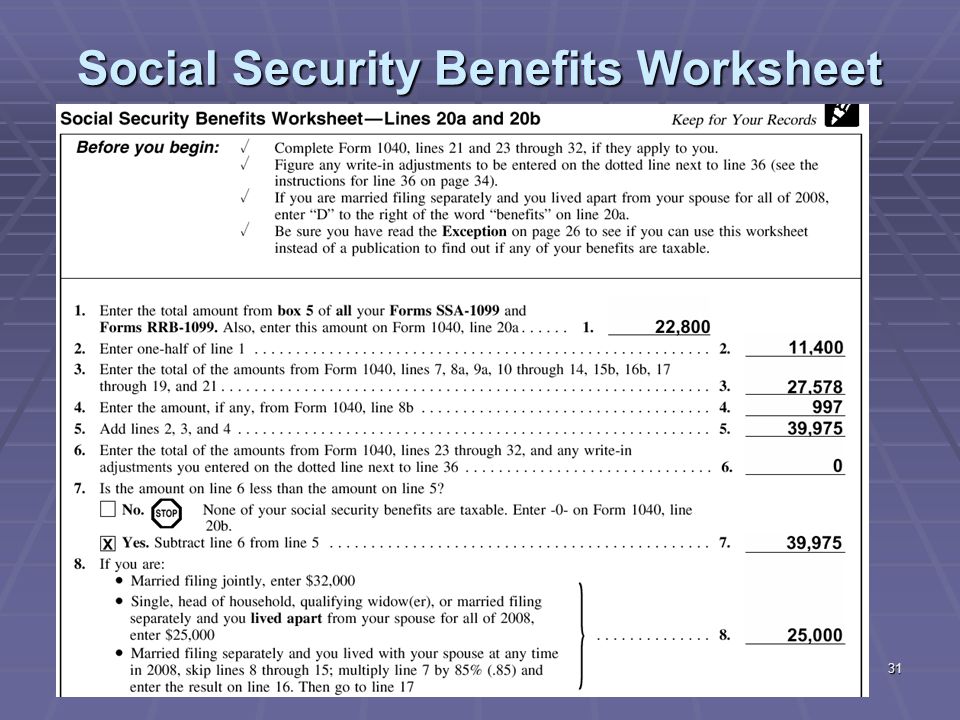

Social security calculation worksheet a. Some of the worksheets displayed are benefits retirement reminders railroad equivalent 1 30 of 107 2019 form w 4 your retirement benefit how its figured 2019 form w 4 2019 form w 4 form w 4p for teachers retirement system of the state of 2019 form w 4. Social security benefits worksheetlines 20a and 20b form 1040 instructions html. If you are concerned about a huge tax bill at the conclusion of the calendar year you can earn tax payments on your social security income throughout the year.

Social security benefits worksheet taxable amount if your income is modest it is likely that none of your social security benefits are taxable. 2012 social security benefits worksheet. Figure any write in adjustments to be entered on the dotted line next to line 36 schedule 1 form 1040. Some states tax social security benefits as a piece of income but others dont or only tax some of your benefits.

Showing top 8 worksheets in the category 2019 social security. It also allows you to estimate what you would receive at age 66 and 6 months your full retirement age. Luckily this part is easy. Figure any write in adjustments to be entered on the dotted line next to schedule 1 line 36 see the instructions for schedule 1 line 36.

How to file social security income on your federal taxes. Adds lines a and b results in 2020 gross benefit. Multiplies line a by line b.

%20screen%201.jpg)