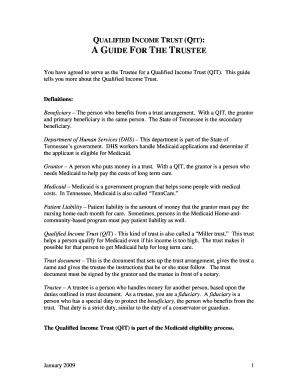

Florida Qualified Income Trust Template

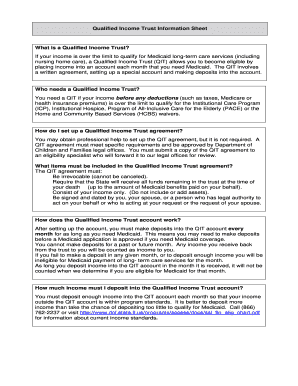

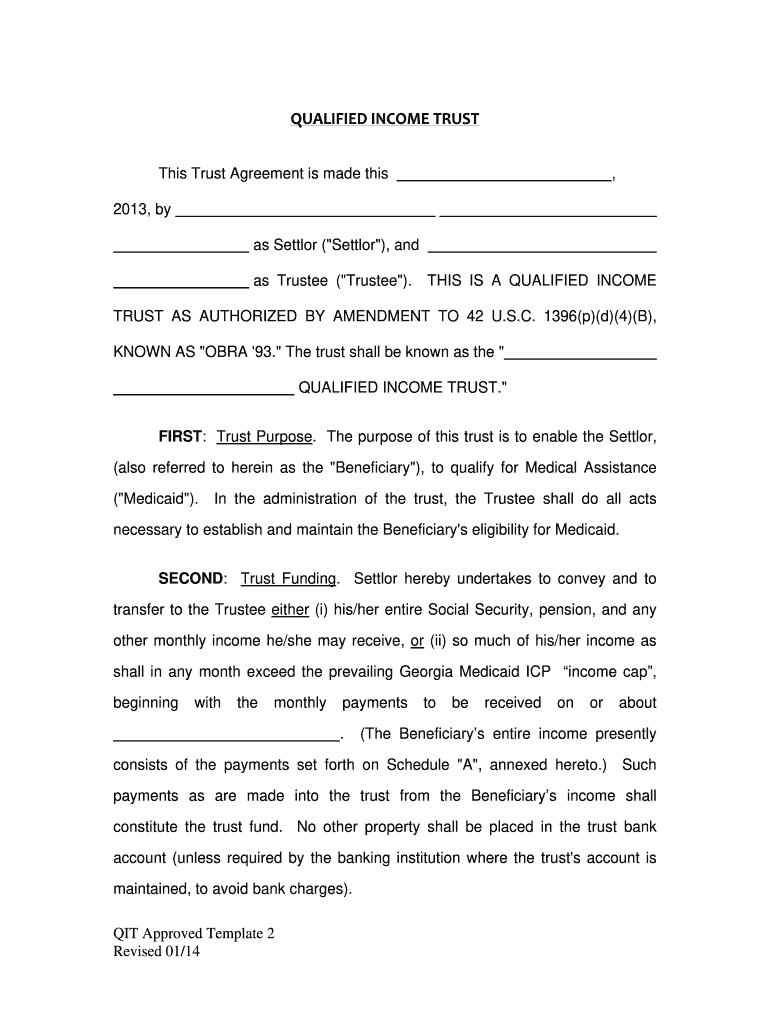

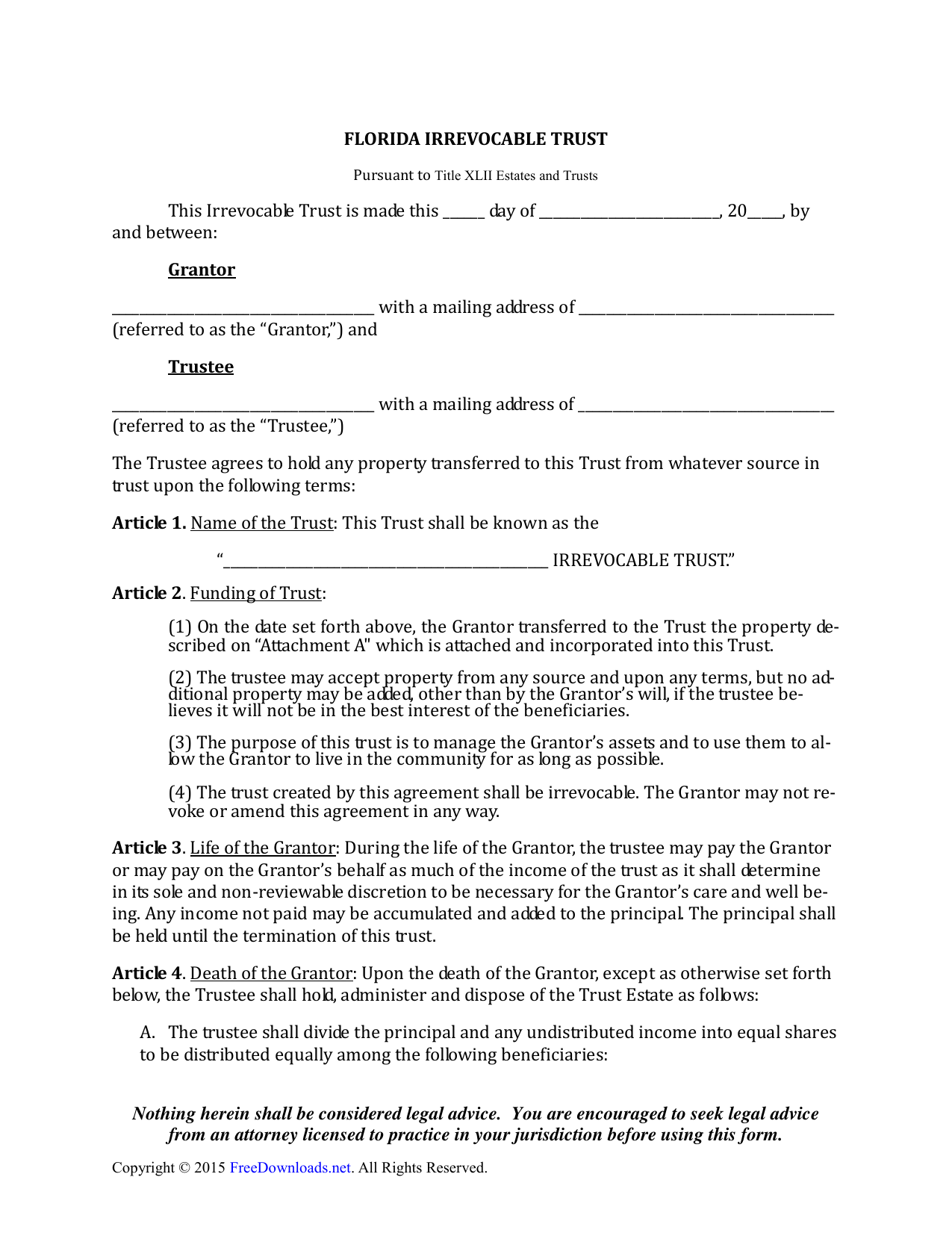

An irrevocable qualified income trust in florida which is sometimes referred to as a miller trust or qit form is a trust that is allowed by florida medicaid lawthe qit form allows someone who is ineligible for florida medicaid benefits to pay for skilled nursing care because they have too much income.

Florida qualified income trust template. Fees not taken during the month cannot be taken in a subsequent month. Refer to chapter 1640 in the access florida program policy manual the qualified medicaid pooled trust for disabled individuals is a legal instrument which meets criteria in 42 usc. The irrevocable florida qualified income trust or miller trust that you prepare online for a fixed fee of 295 is reviewed by florida elder law attorney c. 1396 pd4c and which allows disabled individuals to place assets andor income into a trust to qualify for medicaid assistance.

Qualified income trusts can be established by the medicaid applicant hisher spouse. If the applicant has a pooled trust however the income may be placed into it instead but this must also be done on a monthly basis if you want to have medicaid. In florida the income cap established by medicaid is 231300 per month as of january 2019 the medicaid income cap changes periodically. The trustee may expend anot more than 20 month for banking costs to administer the trust.

Establishing a miller trust for individuals residing in nursing homes or who are receiving the home and community based services under a medicaid waiver the applicable income standard is 2349 per month amount effective january 1 2020. This instrument is designed for those over the income limit but who do not receive enough monthly income to pay for their nursing care facility costs. A qualified income trust or qit is a mechanism to qualify for benefits when ones income exceeds the income limit currently 219900 per month in fl. Miller trusts are solely designed to own income to get around medicaids income caps.

If an applicant wants long term medicaid in florida and the income exceeds the cap a qit will be necessary. The qit involves a written agreement setting up a special account and making deposits into the account.