Tax Certification Class

All volunteers requesting continuing education credits are required to meet tax law certification requirements via link and learn taxes.

Tax certification class. Volunteers can earn a maximum of 18 continuing education credits. How to complete your requirements youll need to complete your free online continuing education courses using the states online statewide learning management system slms. The educational services unit at the office of real property tax services administers the new york state assessment certification program for. The irs course for tax preparers tax return preparer certification does not count toward your required new york state hours of coursework.

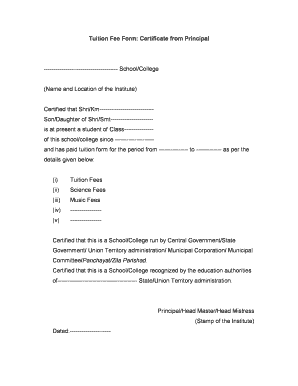

Upon successful completion of the course we will send you a certificate. Covered tax returns means your federal excluding non resident state and local tax returns for the tax year stated on the worry free guarantee certificate that are prepared by a jackson hewitt tax service tax preparer and are dated the same date of the certificate. Volunteers cannot be compensated for their work as instructors quality reviewers or tax return preparers if they are seeking ce credits. We offer irs and ctec approved comprehensive tax training courses.

Prior to that you may find only a very small number of states with classes scheduled. In this beginner tax preparer course you will learn to prepare tax returns and research tax issues for most form 1040 individual non business taxpayers and small business taxpayers self employedschedule c. California edition is ctec approved. County directors assessors real property appraisers and candidates for assessorassessment training is also available and encouraged for county and local assessment staff.

Liberty tax service has been approved by the california tax education council to offer liberty tax school ctec course 2097 qe 0001 which fulfills the 60 hour qualifying education requirement imposed by the state of california to become a tax preparer. Learn tax preparation with our comprehensive tax course. Irs tax training is the nations leading school for tax professionals online. About the comprehensive tax course.

Tax practitioner institutes are generally sponsored by state universities and community colleges in partnership with the irs to deliver high quality continuing education credits to the tax professional community at reasonable cost. Download irs tax training courses online today. Plus the basics of schedule cself employed tax returns.

.png)

/how-to-invest-tax-lien-certificates-4156474_v4-07a1533f0d804376a110dad6664ed2df.png)