Should I Keep My Receipts

Keep the receipts for items that are covered by warranties such as major appliances until the warranty expires.

Should i keep my receipts. Unless you want to fake a receipt illegal in case you didnt know keeping those receipts just in case is a good idea. You can reduce the capital expense and. If youre not satisfied return it within 60 days of shipment with your. Businesses should keep all.

The only proof of purchase though is through your receipt. Save it for warranties. Which receipts should i keep for taxes. Thats because you can get reimbursements in many situations like recalls or may need to take the item back.

How long should you keep receipts and bills. Housing records specifically receipts that show improvements should be kept for as long as you own your home plus six years. Maintain the title for your vehicles for as long as you own it. Time duration for maintenance of receipts and bills is a question of debate.

Yes you should be saving every receipt for future deductions on your taxes several tax professionals told hellogiggles. Keeping receipts is a good habit but how long should one keep a receipt. Receipts and bills are commonly issued by service and utility providers as an acknowledgement towards payment of dues and charges by you. For purposes of this article were speaking about personal receipts for managing your household.

When we work with clients in person to sort out their papers and create systems for them we always run into the issue of keeping receipts. If youre not satisfied return it to intuit within 60 days of purchase with your dated receipt for a full refund. The length of time by which any receipt will be kept depends on the kind of bills that were paidhaving lot of receipts in your drawer can result in clutter and disorganization. In other words keep the receipts for your new laptop until its.

There is a school of thought that you should keep a receipt until you get rid off whatever you purchased for instance you should hold on to a receipt from the grocery store until you finish off your gallon of milk. My article will guide you with the procedure. Some people especially old ones are fond of keeping receipts. The following are some of the types of records you should keep.

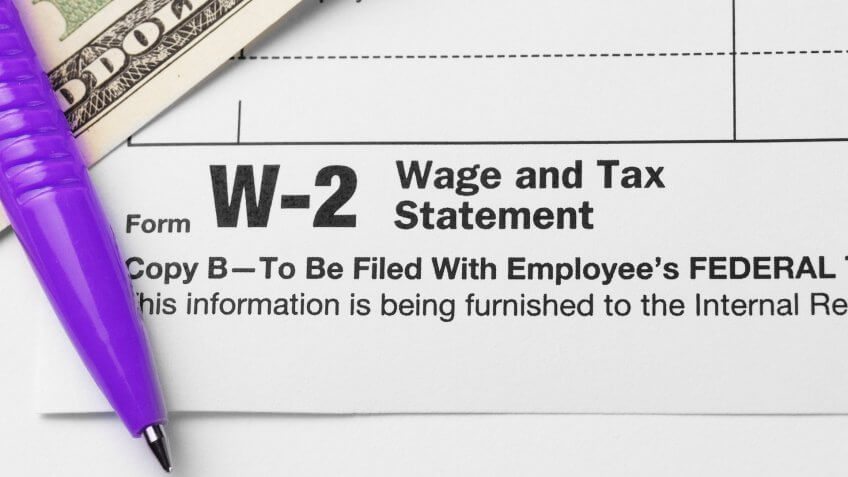

It is important to keep these documents because they support the entries in your books and on your tax return. Updated for tax year 2019. Your credit card could have a program the stores have them and your spouse might even offer it. For instance organize them by year and type of income or expense.

Gross receipts are the income you. Keep your purchase documents and also all home improvement records which can be used to calculate your cost basis when you sell your home potentially saving you a bundle.