Sales Receipt Invoice

Creating sales receipt from invoice will double the entry in your register.

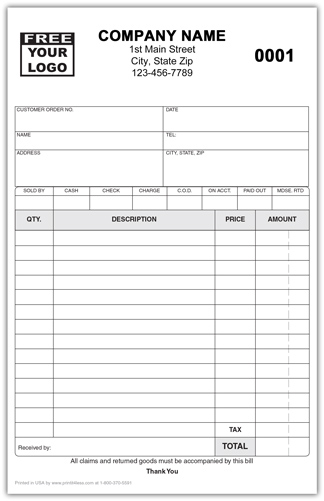

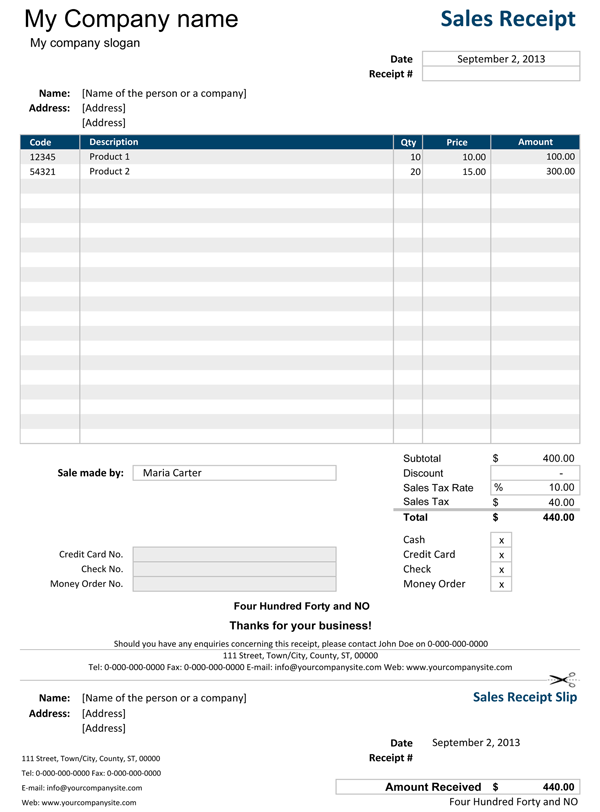

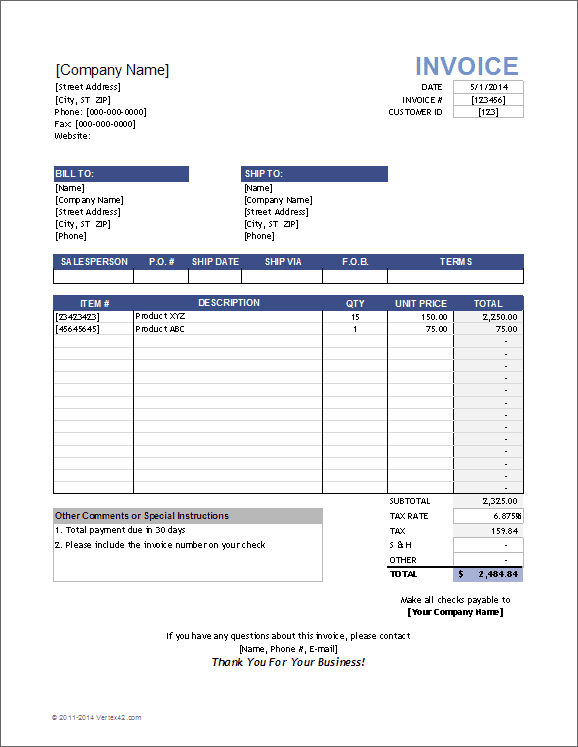

Sales receipt invoice. The payment happened at the time of the sale or before. Combined taxable and nontaxable items when taxable and nontaxable items or services are sold together as one package the amount of the taxable receipt can change. The invoice helps the seller to keep the record of sale and to determine that amount of merchandise has been received or not. Since you got your invoice automatically from third party software you can use receive payment to know that it has been paid.

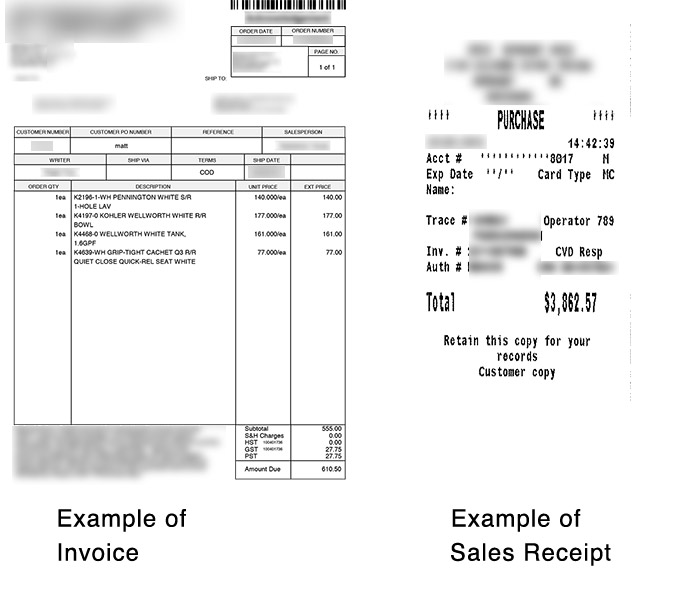

Sales invoice and official receipt both are a prominent part of the purchase cycle. For a deferred payment you can use the invoice and receive payment. The buyer can also track and match the details of goods or services listed on the invoice are received. Invoices an invoice is a bill that details goods and services that have been or will be purchased by a buyer.

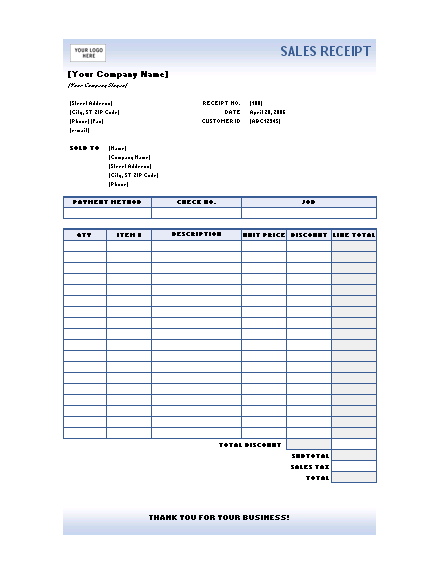

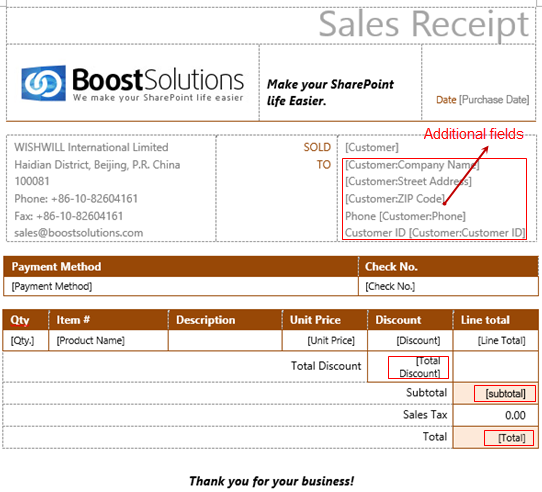

You can print the paid invoice instead and give it to your client. It may also be known as a purchase invoice or commercial invoice. After receiving the payment you need to issue a sales receipt. A sales receipt is used when your customer pays you on the spot for goods or services.

You must separately state the total amount of sales tax due on any receipt or invoice that you give to your customer. Sales invoice list down the details of the items or goods sold. In this situation there wasnt an invoice issued before the payment so it was either a cash sale or a prepayment. It will also be the basis of the output tax liability of the seller and the input tax claim of the buyer.

Businesses often receive payments at the time of the transaction or earlier. Moreover provide a note in the memo section as to which phase of the construction has been paid for this transaction only. Sales invoice is issued by the seller to the buyer as written evidence on sale of goods or properties in an ordinary course of business whether cash or on account credit. A sales invoice is a document issued by a seller to a buyer.

You can set up terms to indicate how long the customer has to pay. However for immediate payment you need to use sales receipt. Go to sales and click the customers tab. Heres how to print the paid invoice.

A sales receipt is always issued from the seller to the buyer at the time of payment.