Retail Resale Certificate

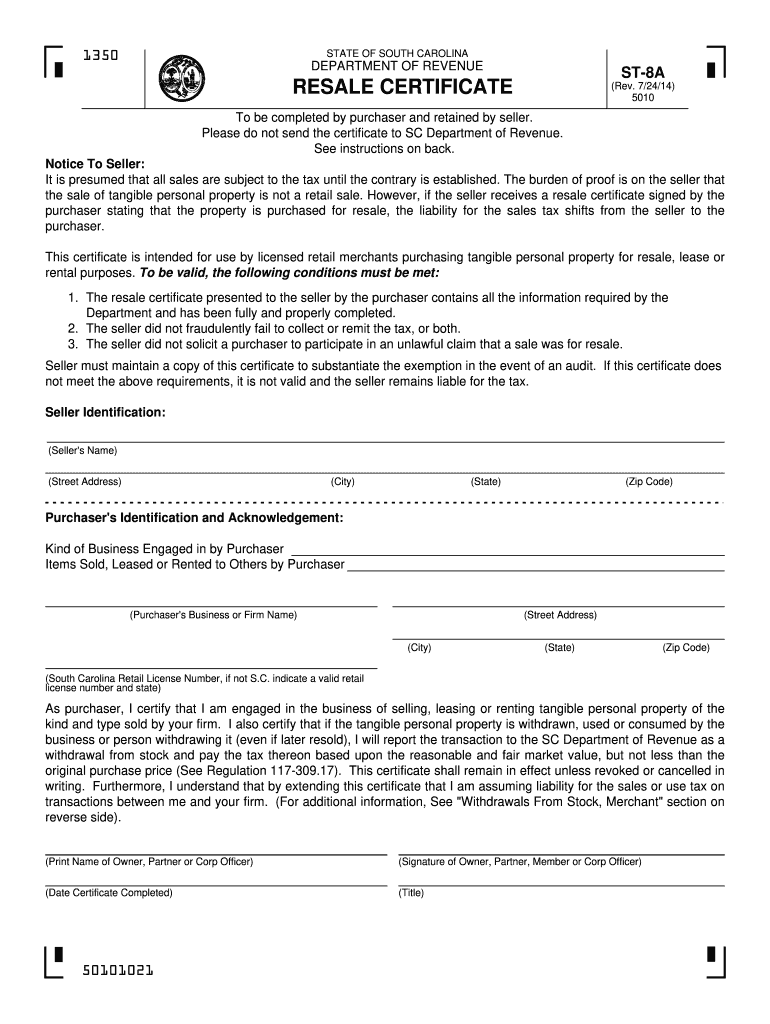

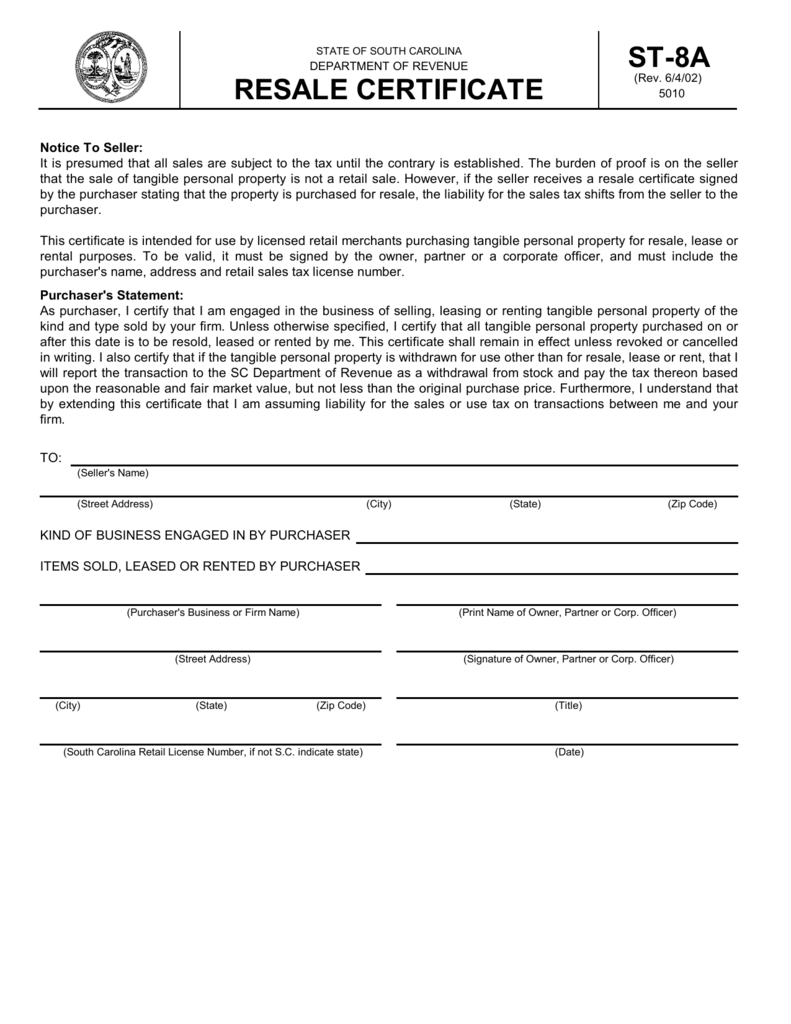

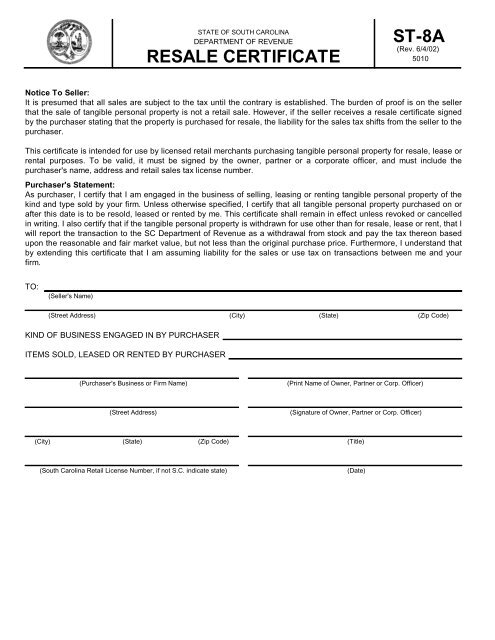

Form number instructions form title.

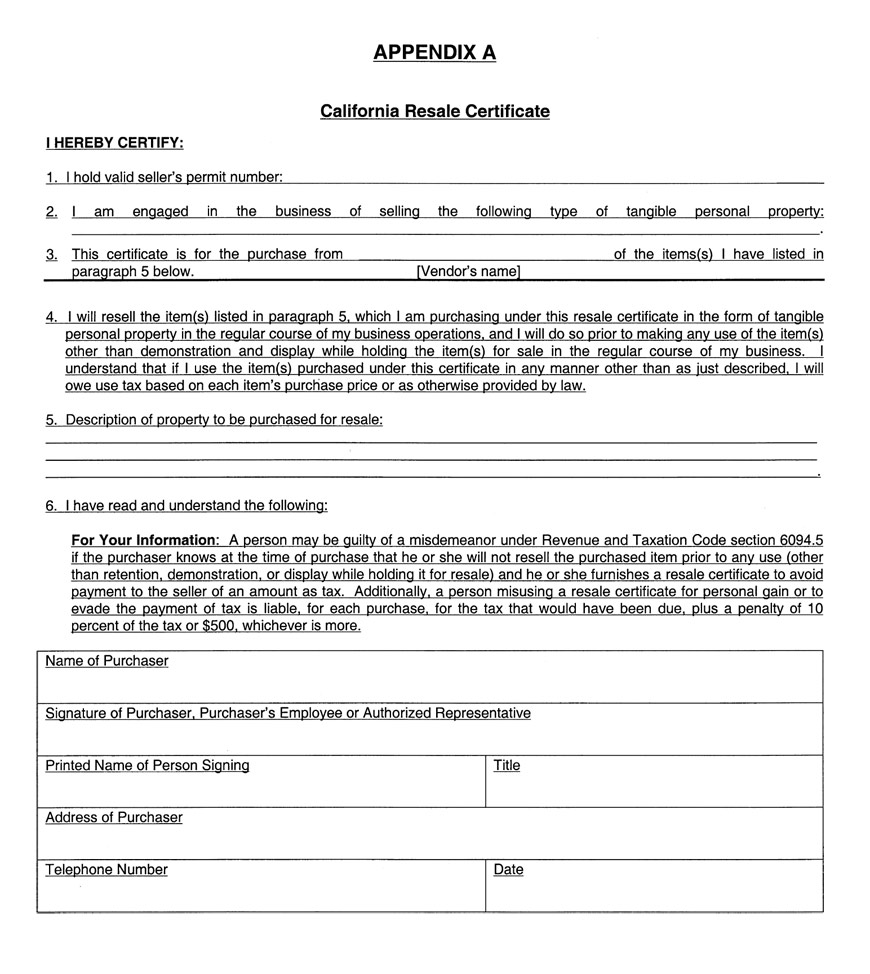

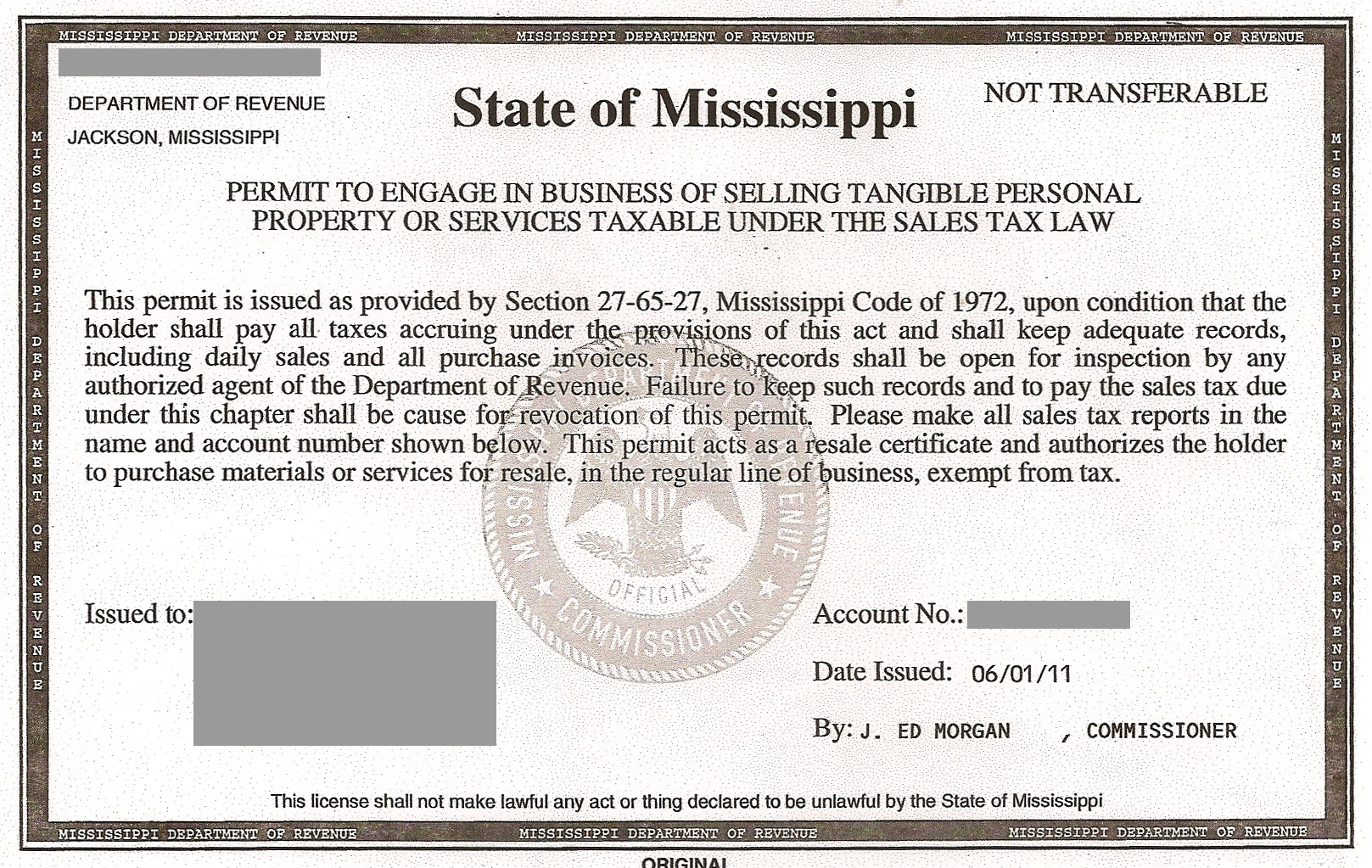

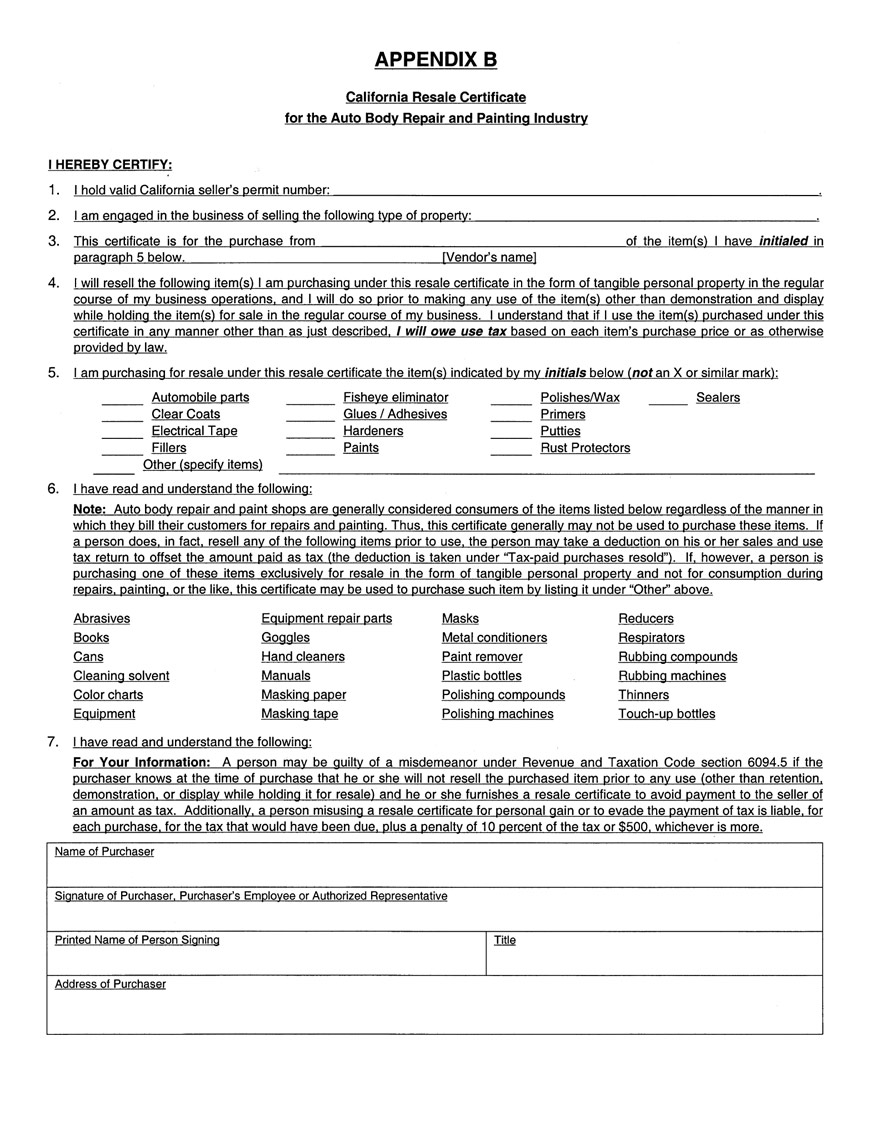

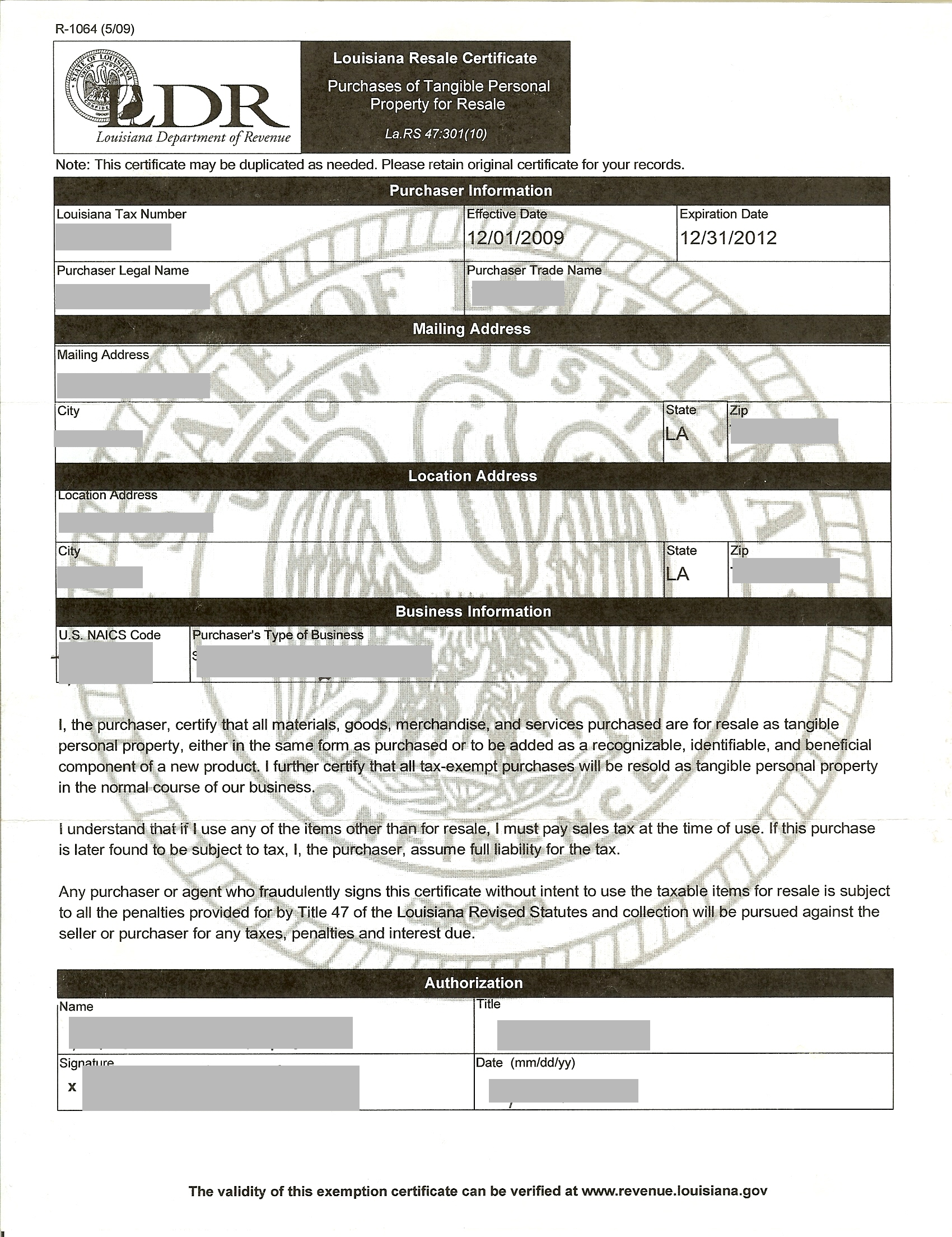

Retail resale certificate. A resale certificate is a signed document that indicates that the purchaser intends to resell the goods. However if the seller receives a resale certificate signed by the purchaser stating that the property is purchased for resale the liability for the sales tax shifts from the seller to the purchaser. In addition manufacturers issue resale certificates to suppliers of materials that become. A resale certificate is an official document that easily instills confusion in many online resellers.

Reseller permits are generally valid for four years. Businesses that register with the florida department of revenue to collect sales tax are issued a florida annual resale certificate for sales tax annual resale certificate. The purpose of the certificate is to document the purchase of tangible personal property for resale in the purchasers regular course of business. Contractor exempt purchase certificate.

Retailers and wholesalers to purchase items for resale without paying sales tax. To document tax exempt purchases of such items retailers must keep in their books and records a certificate of resale. Manufacturers to purchase ingredients or components that are used to create a new article for sale without paying sales tax. This certificate is only for use by a purchaser who.

A is registered as a new york state sales tax vendor and has a valid certificate of authority issued by the tax department and is making purchases of tangible personal property other than motor fuel or. Sales tax is then collected and paid when the items are sold at retail. This registration also allows you to buy items from retailers tax. It is usually provided by a retailer to a wholesale dealer.

Any other use of the resale certificate is usually considered unlawful. New york state and local sales and use tax exemption certificate tax on occupancy of hotel or motel rooms. If you wish to use a new york resale certificate. Sales tax exemption documents.

The vendor shall retain this certificate for single transactions or for specified. The certificate allows business owners or their representatives to buy or rent property or services tax free when the property or service is resold or re rented. Reseller permits are distributed by the state and allow. St 1201 fill in instructions on form.

Sales tax exemption documents. Illinois businesses may purchase items tax free to resell. Form st 120 resale certificate is a sales tax exemption certificate. This certificate is intended for use by licensed retail merchants purchasing tangible personal property for resale lease or rental purposes.

To use a new york resale certificate sometimes called a resellers permit you must already be registered to collect sales tax in the state of new york. Depending on the state you live in it can also be called a resellers permit resellers license resellers certificate resale license sales tax id or sales tax permit.