Receipts For Non Profit Organization Donation

Nonprofit organizations need donors like a fish needs water.

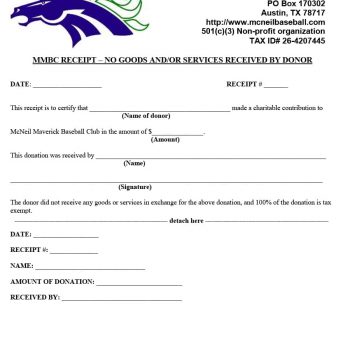

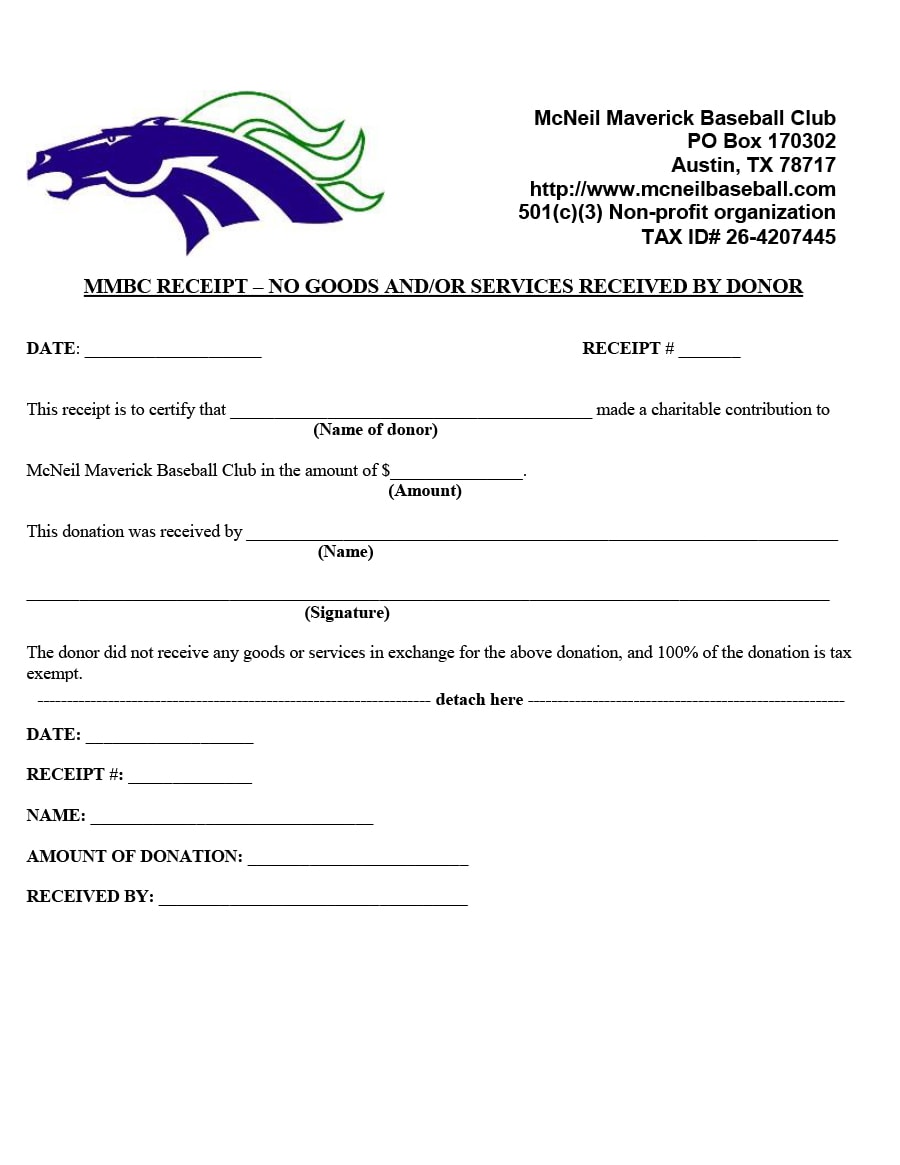

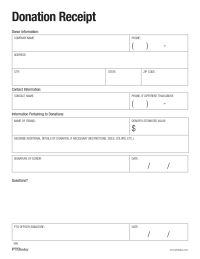

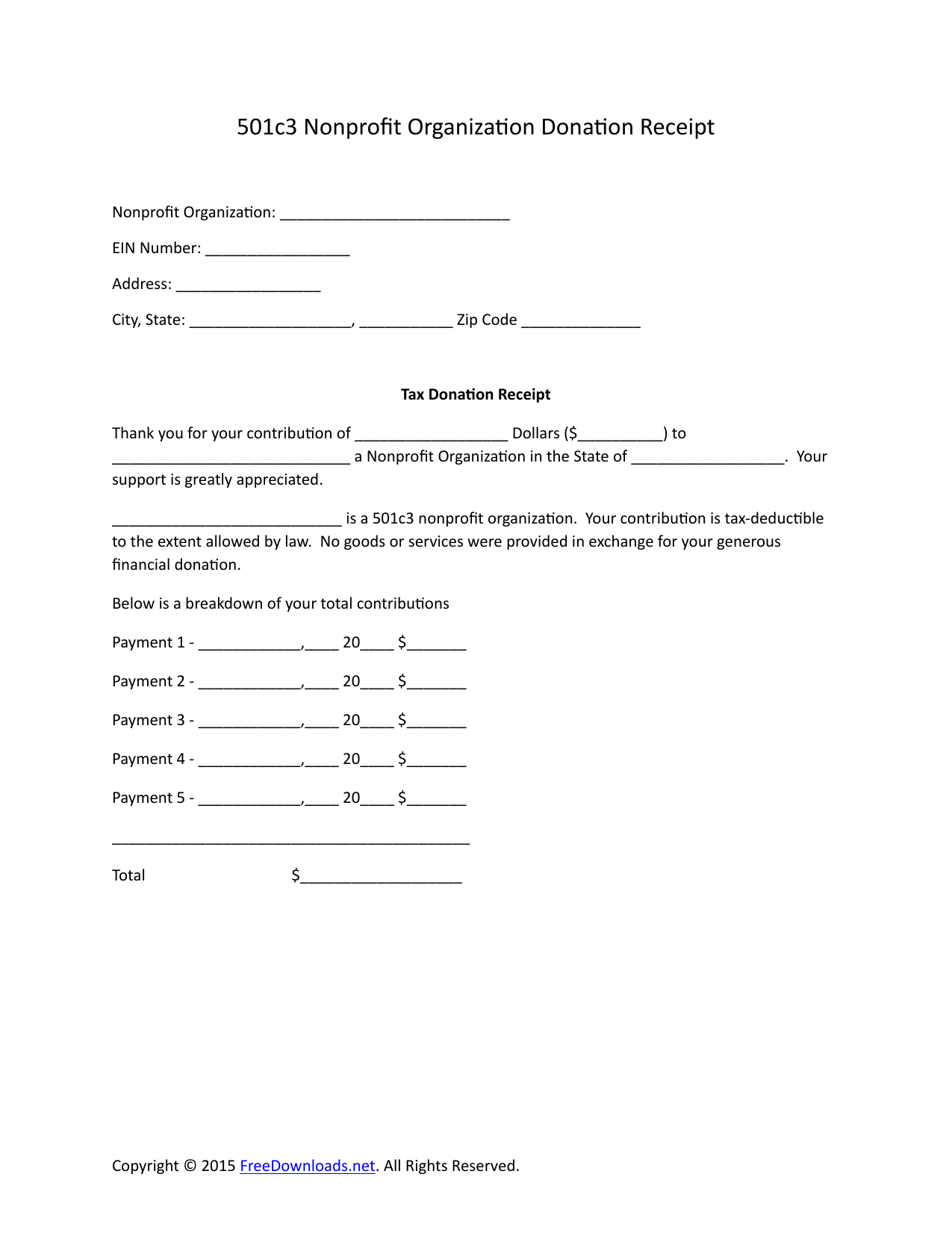

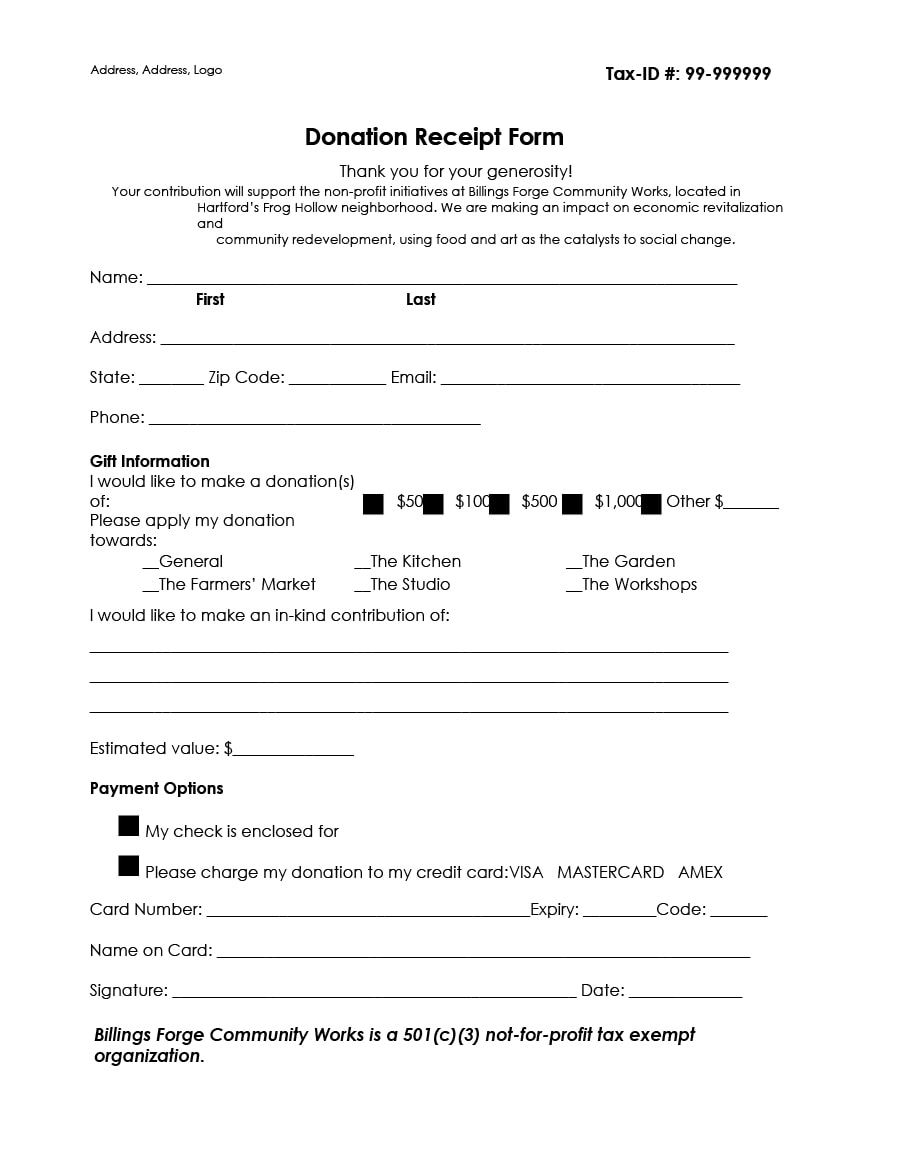

Receipts for non profit organization donation. Organizations using donorbox our powerful and effective donation software can very easily generate 501c3 compliant tax receiptsthis includes both receipts for every individual donation and consolidated receipts of the entire year of donations. How to create a 501c3 compliant receipt using donorbox. Fortunately for those who like to give charitable donations are tax deductible as long as they are itemized and recorded. Donation receipt your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible.

For the beneficiaries non profit organizations donation receipts serve as legal documents or legal requirements for non profit organizations. In order to realize this benefit the donor must receive a properly written receipt as record of the transaction. To nonprofit organizations donation receipts are an essential part of bookkeeping and maintaining their nonprofit status. But despite their necessity theres no single standard format for donation receipts.

It is a microsoft word document so that you can easily customize it to make it work based on your needs. Customize the nonprofit donation receipt template. When the irs asks for these documents and the organization is unable to present them they can be charged with a penalty depending on the cause of the donation.