Quantitative Analyst Certification

Becoming a quantitative analyst typically requires a masters degree in quantitative finance financial engineering or a related quantitative field such as physics statistics or math.

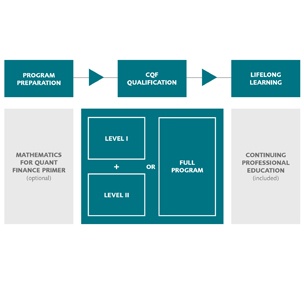

Quantitative analyst certification. The classes cover a variety of topics in economic theory mathematics statistics finance and government. The certificate in quantitative finance cqf is designed to transform your career by equipping you with the specialist quant skills essential to success. Thats why the emphasis is on teaching current real world techniques you can apply with confidence from the moment you learn them. Part speculator part ruthless logician a quants aim is to reduce risk andor generate profits.

For all of the lectures the lesson rarely ends at a mathematical equation but goes a step further in showing results of the tests with more assignments in conducting these strategies. Many programs offer courses in quantitative analysis preparing graduates for entry level positions in the field. You need to do coding also. This course is great introduction to the world of quantitative trading with a focus on real world practicality instead of just solely mathematical equations.

Your job as a quantitative analyst is to perform dailyregularly statistical analyses like risk analytics loan pricing default risk modeling etc. Educational qualifications a long term career as a quantitative analyst generally requires a graduate degree in a quantitative field such as finance economics mathematics or statistics. Known in the business as quants quantitative analysts develop and implement complex mathematical models that financial firms use to make decisions about risk management investments and pricing.