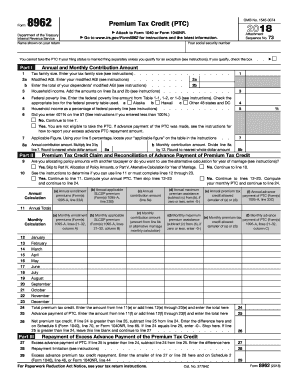

Printable Copy Of Form 8962

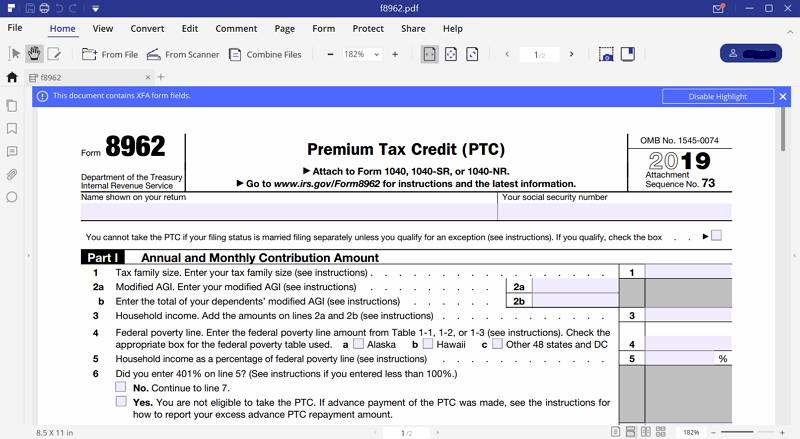

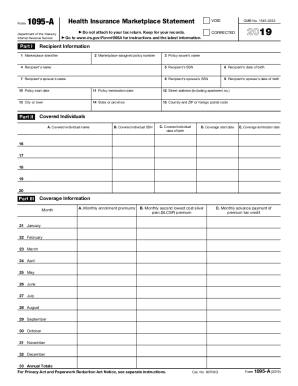

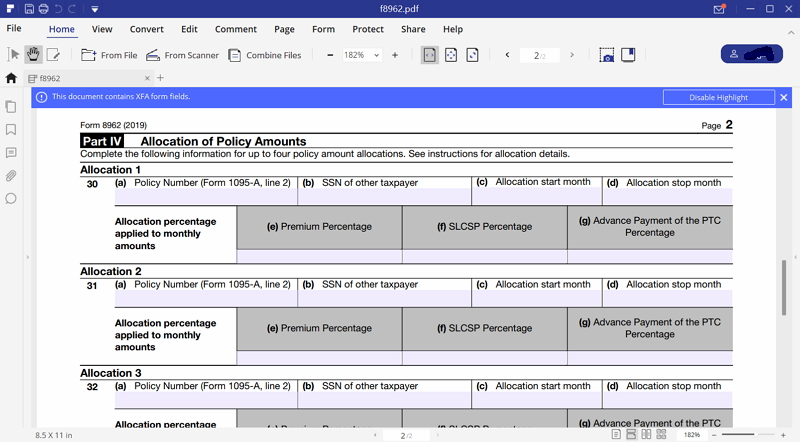

Multiply the amounts on form 1095 a by the allocation percentages entered by policy.

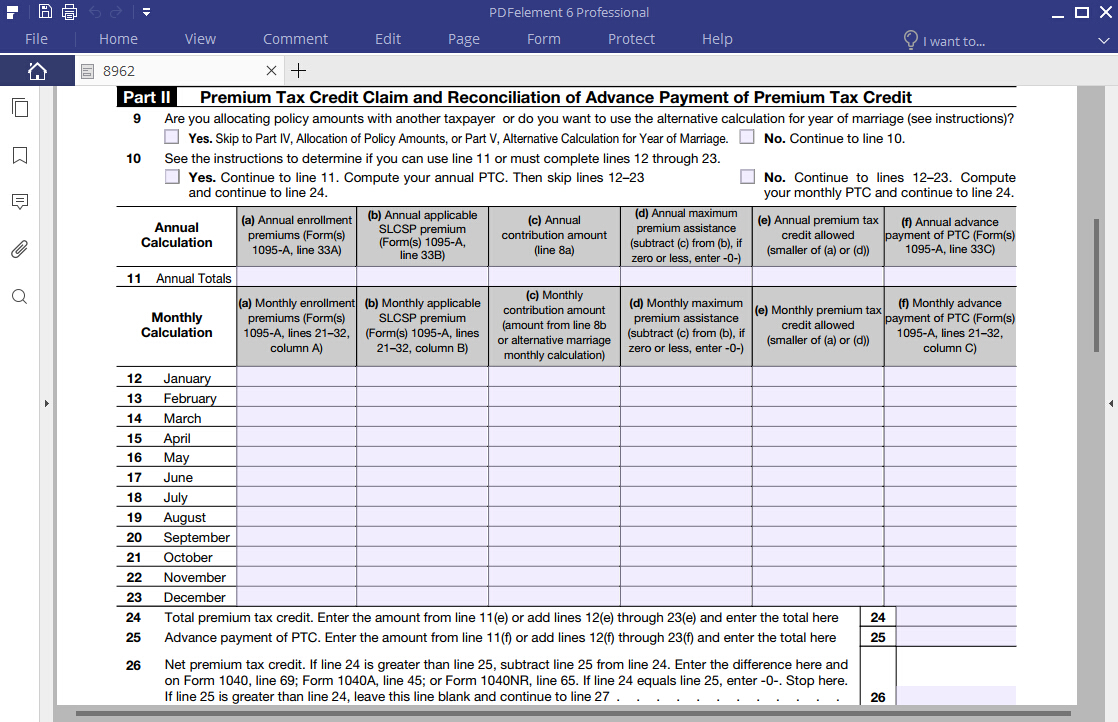

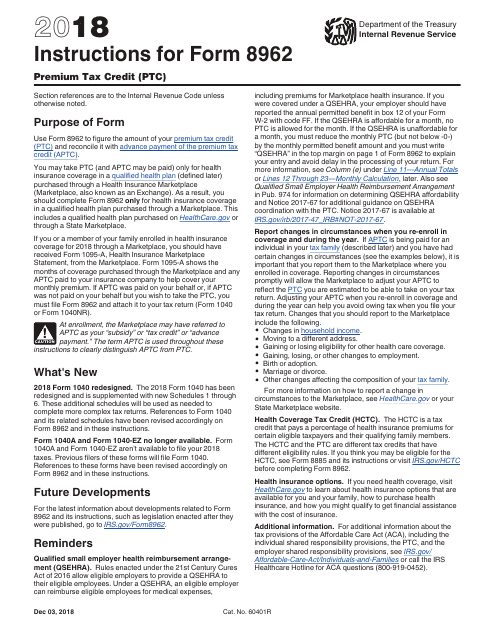

Printable copy of form 8962. Information about form 8962 and its separate instructions is at. Figure the amount of your premium tax credit ptc. An individual needs 8962 form to claim the premium tax credit. Enter the combined total for each month on.

Or you can select forms filed with the government plus all worksheets. You can view the forms from here and select just to print the pages with. Use form 8962 to. Fillable printable form 8962 what is a form 8962.

Part ivallocation of policy amounts see the instructions for line 1 and line 9 to determine whether you need to complete part iv. A copy of the irs letter that you received. For paperwork reduction act notice see your tax return instructions. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit.

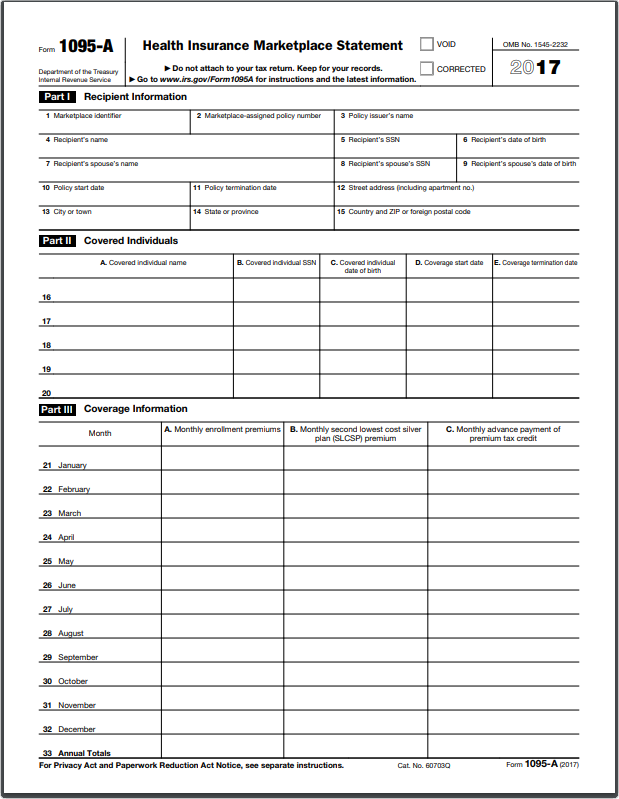

Form 8962 is known as an internal revenue service form that used for figuring the amount of your premium tax credit which abbreviates as ptc and reconcile it with any advance payments of the premium tax credit you know which is also called aptc. Form 8962 and either form 1040 or 1040a if needed a. Add all allocated policy amounts and non allocated policy amounts from forms 1095 a if any to compute a combined total for each month. Copy of your form 1095 a health insurance marketplace statement.

Send the following to the irs address or fax number given in your irs letter. Add all allocated policy amounts and non allocated policy amounts from forms 1095 a if any to compute a combined total for each month. Also enter the amount from form 8962 line 29 on schedule 2 form 1040 or 1040 sr line 2 or form 1040 nr line 44. On the print and save your tax return screen select print to print the forms you need.

Form 8962 department of the treasury internal revenue service premium tax credit ptc attach to form 1040 1040a or 1040nr. 37784z 29 form 8962 2019 form 8962 2019 part iv page 2 allocation of policy amounts complete the following information for up to four policy amount allocations. It is used to report your credit amount on your tax return and reconcile the advance credit payments made on your behalf. See instructions for allocation details.

Multiply the amounts on form 1095 a by the allocation percentages entered by policy. Form 8962 premium tax credit. You can apply digital irs form 8962 to learn your ptc amount.