Ny State Tax Forms Printable

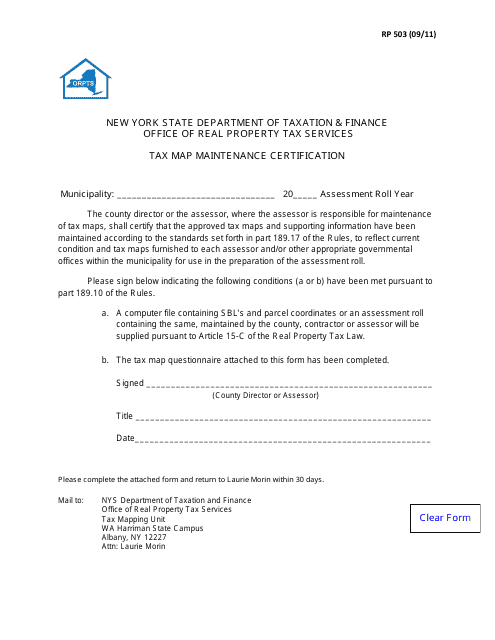

Please see form tp 64 notice to taxpayers requesting information or assistance from the tax department for updated information if you are using any documents not revised.

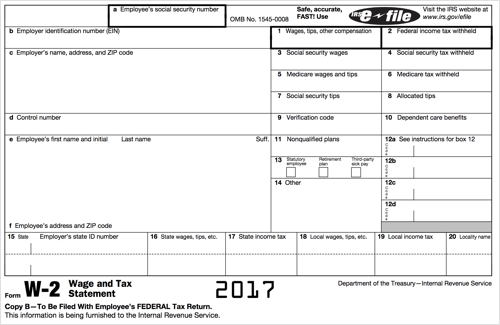

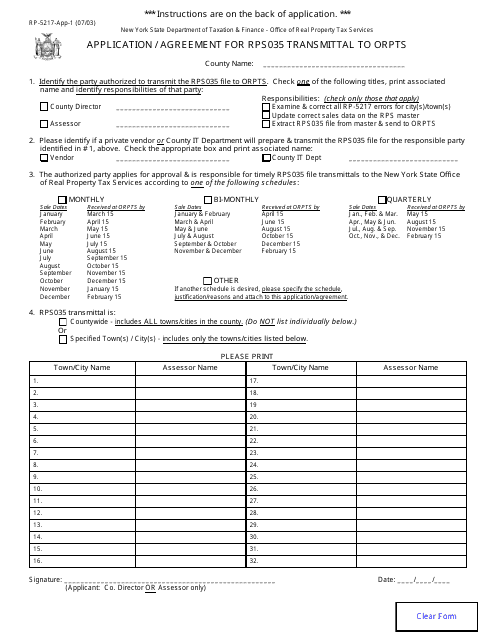

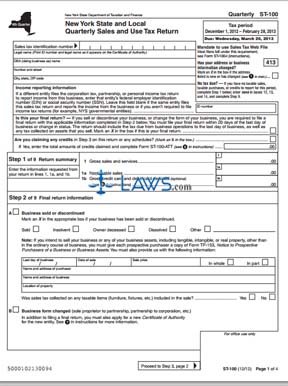

Ny state tax forms printable. Form it 201 is the standard new york income tax return for state residents. Used by taxpayers who carry on business both in and out of new york state nonresidents only or the mctd nonresidents and residents and filed with their income tax returns form it 203 or it 201. Printable new york state tax forms for the current tax year will be based on income earned between january 1 2018 through december 31 2018. Some of the forms and instructions on this web site do not reflect recent changes in tax department services and contact information.

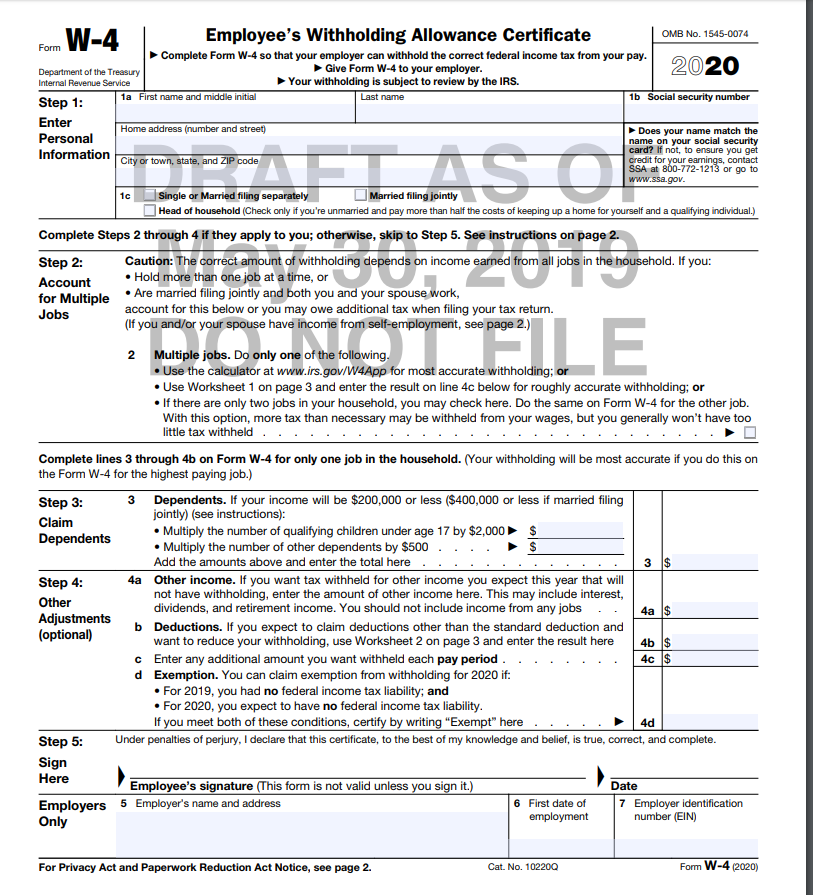

This form is not necessarily revised every year only when necessary. Taxformfinder provides printable pdf copies of 272 current new york income tax forms. Claim the number of withholding allowances you compute in part 1 and part 5 of the worksheet on page 3. The current tax year is 2018 and most states will release updated tax forms between january and april of 2019.

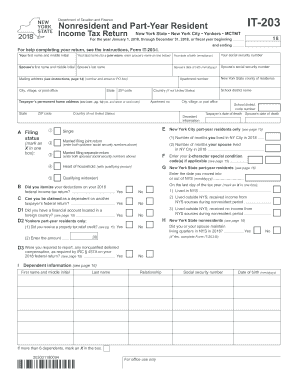

Nonresidents and part time residents must use must use form it 203 instead. New york has a state income tax that ranges between 4 and 882 which is administered by the new york department of taxation and finance. To the new york state tax department. New york printable income tax forms 272 pdfs.

If you claim more than 14 allowances your employer must send a copy of your form it 2104.