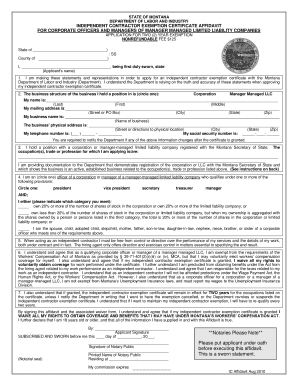

Independent Contractor Certificate

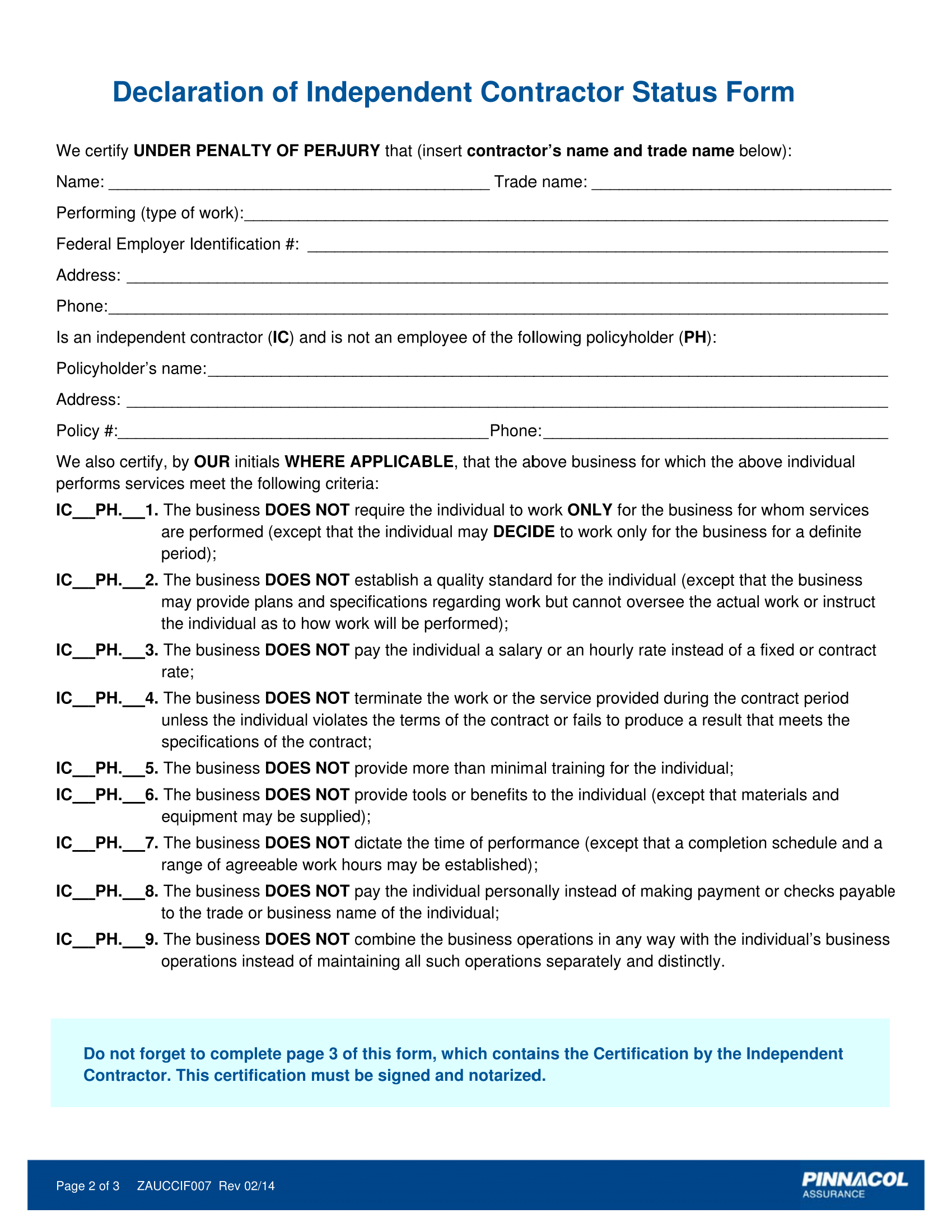

The hired entity performs services for the contractor under the business entitys name.

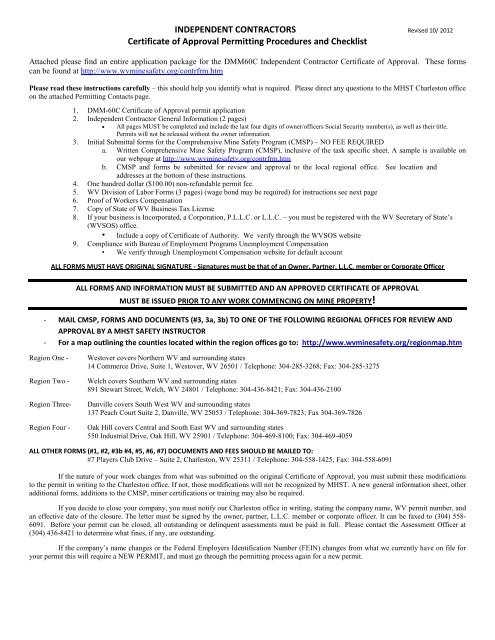

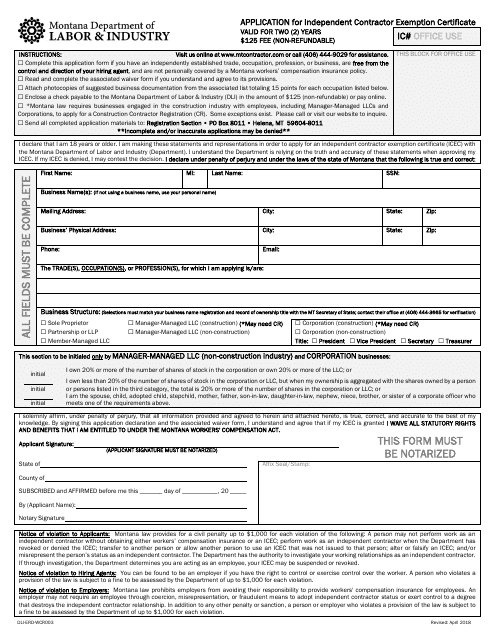

Independent contractor certificate. All appeals must be in writing and mailed to. According to section 51 of the workers compensation law employers must post a form notice of compliance workers compensation law c 105. Lindsay lizzotte maine workers compensation board 27 state house station augusta me 04333 0027. Most employers obtain this form from their workers compensation insurance carrier.

Becoming an independent contractor a worker must be. Any business or worker who is engaged to work independently and outside of normal business operations is considered an independent contractor. You have the right to appeal this decision within 10 days from the date of the boards decision. Frequently asked questions about independent contractor status.

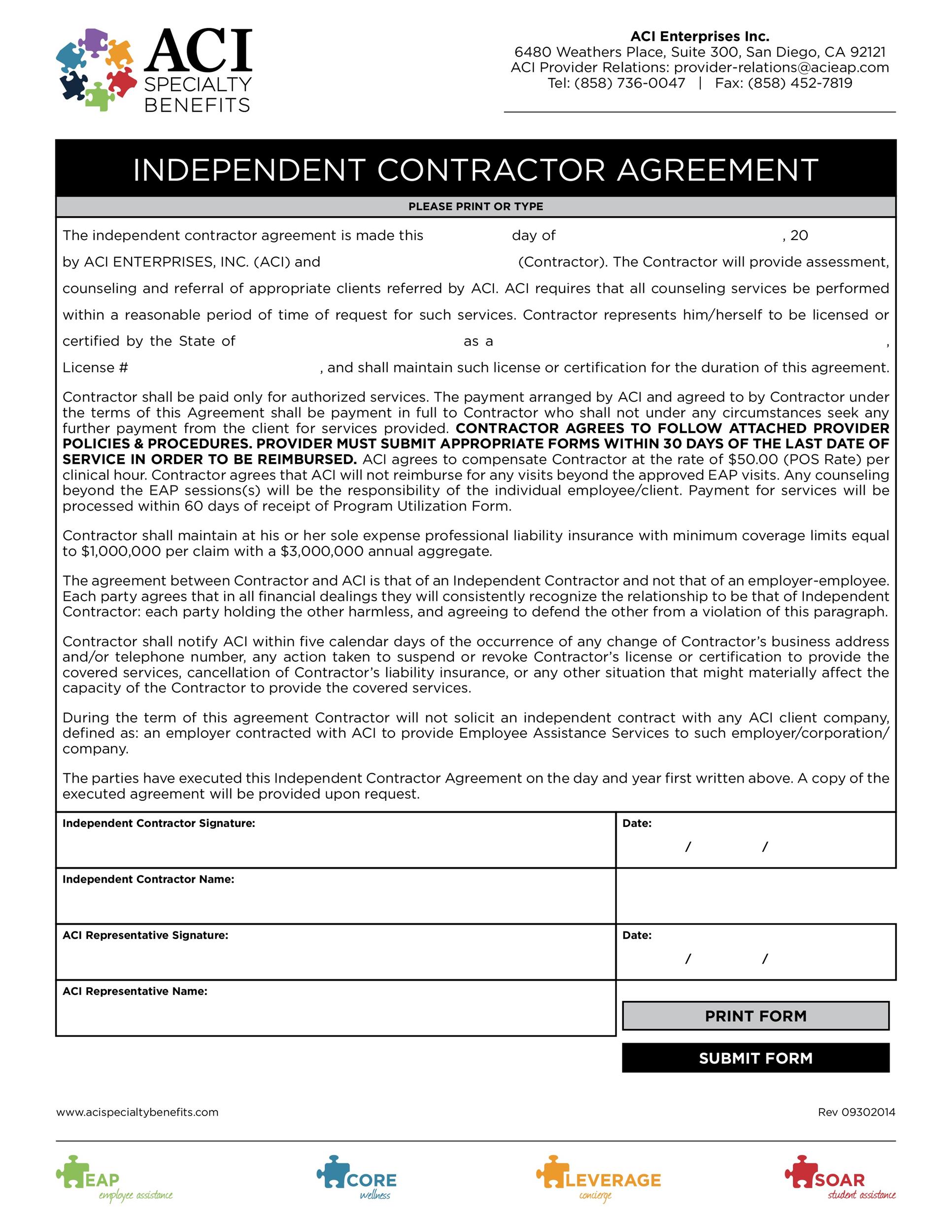

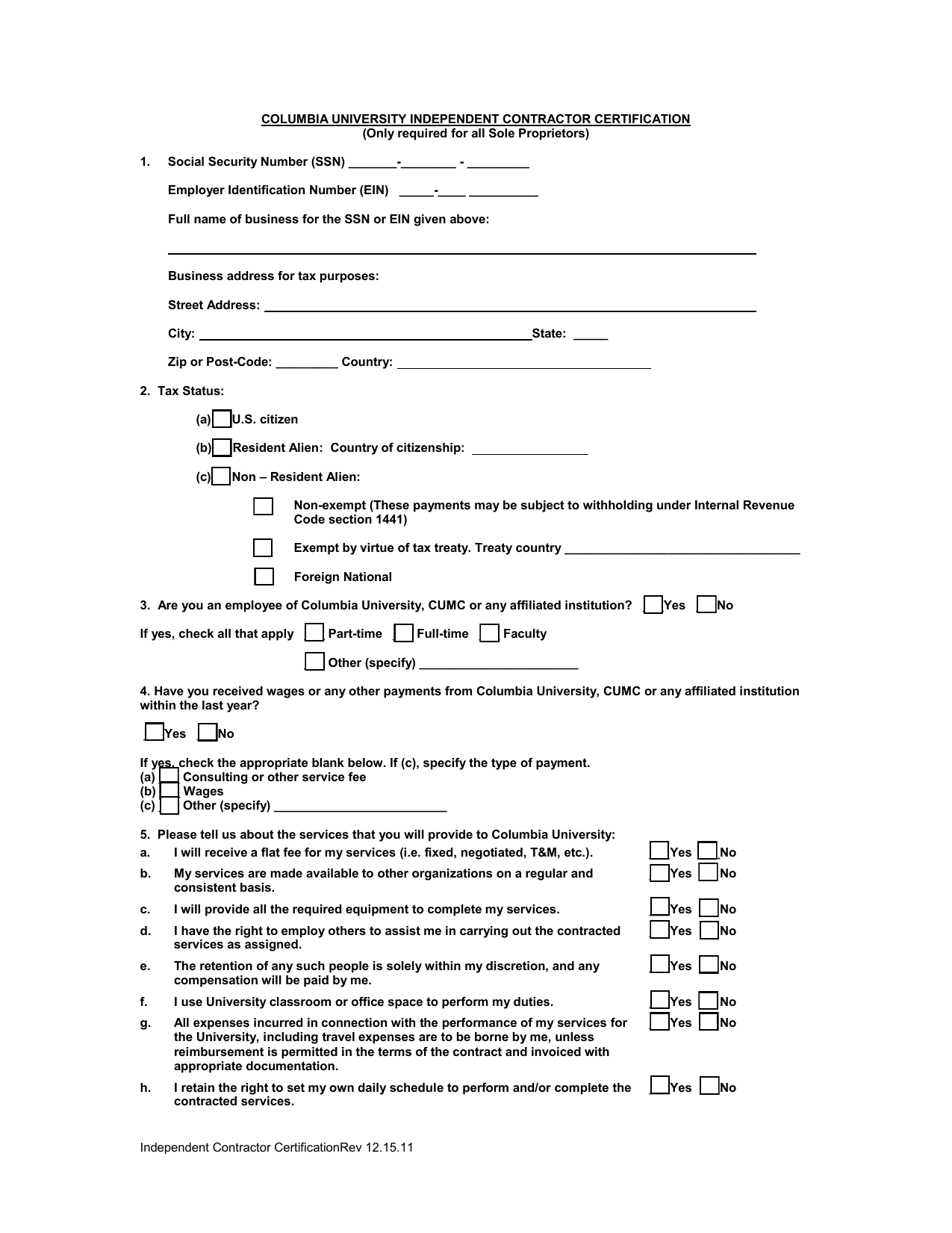

How to obtain an icec. The new york independent contractor agreement is a document that outlines the payment and work entailed for a contractor hired by a client. The hired entity performs services for the commercial goods transportation contractor pursuant to a written contract under the business entitys name specifying their relationship to be as an independent contractor or separate business entity. However whether these people are independent contractors or employees depends on the facts in each case.

Covered under a self elected workers compensation insurance policy or obtain an independent contractor exemption certificate icec. Sb 108 revision of requirements for independent contractor exemption certificates. Posting of notice of workers compensation coverage. Free from control or direction from hiring agent.

Engaged in their own independently established business occupation trade or profession. Independent contractor exemption certificate application pdf this is a fillable application form that must be printed and mailed in. Home inspector registration application pdf. Certification for determination of independent contractor status this form has been developed to assist rowan university in determining whether the individual providing services to the university should be deemed an independent contractor as defined by the internal revenue service or an employee subject to employment tax withholding.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. Also read independent contractors and subcontractors for exceptions.