Hotel Occupancy Tax Receipts Quarterly

The hotel room occupancy tax must be paid on the occupancy or the right of occupancy of a room or rooms in a hotel.

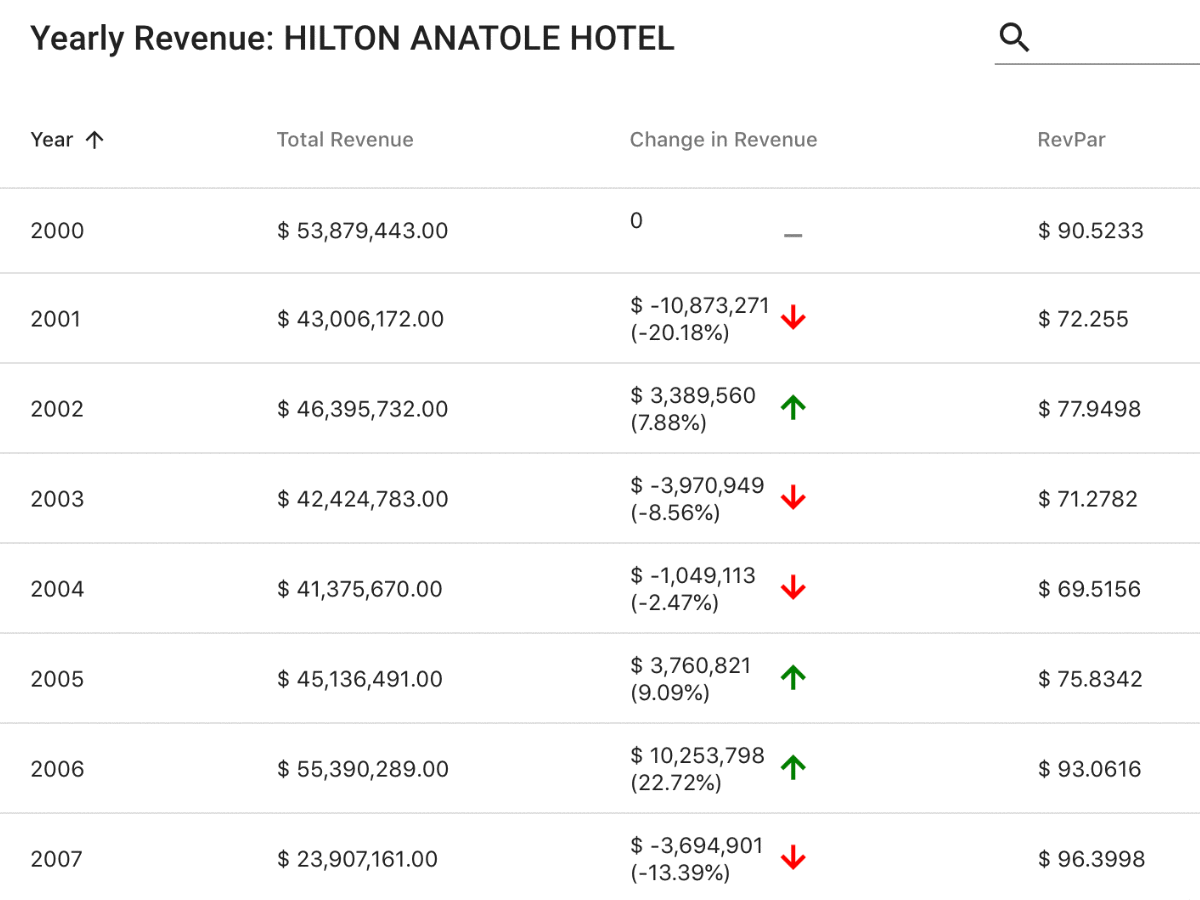

Hotel occupancy tax receipts quarterly. Part 2 hotelmotel room occupancy if you operate a hotel motel or similar establishments in new york city report rents from room occupancy as follows. Previously the tool provided hotel tax information as reported by hotels allowing the user to search and sort hotels by the number of rooms and self reported location inside or outside city limits. Totals a country state of mind llano 000 157500 157500 aat the ranch castell new 517005 517005 adlai properties wiliams lakeshore house kingsland 1516250 4108850 5625100. Totals a country state of mind llano 65000 64000 000 93000 222000 adlai properties.

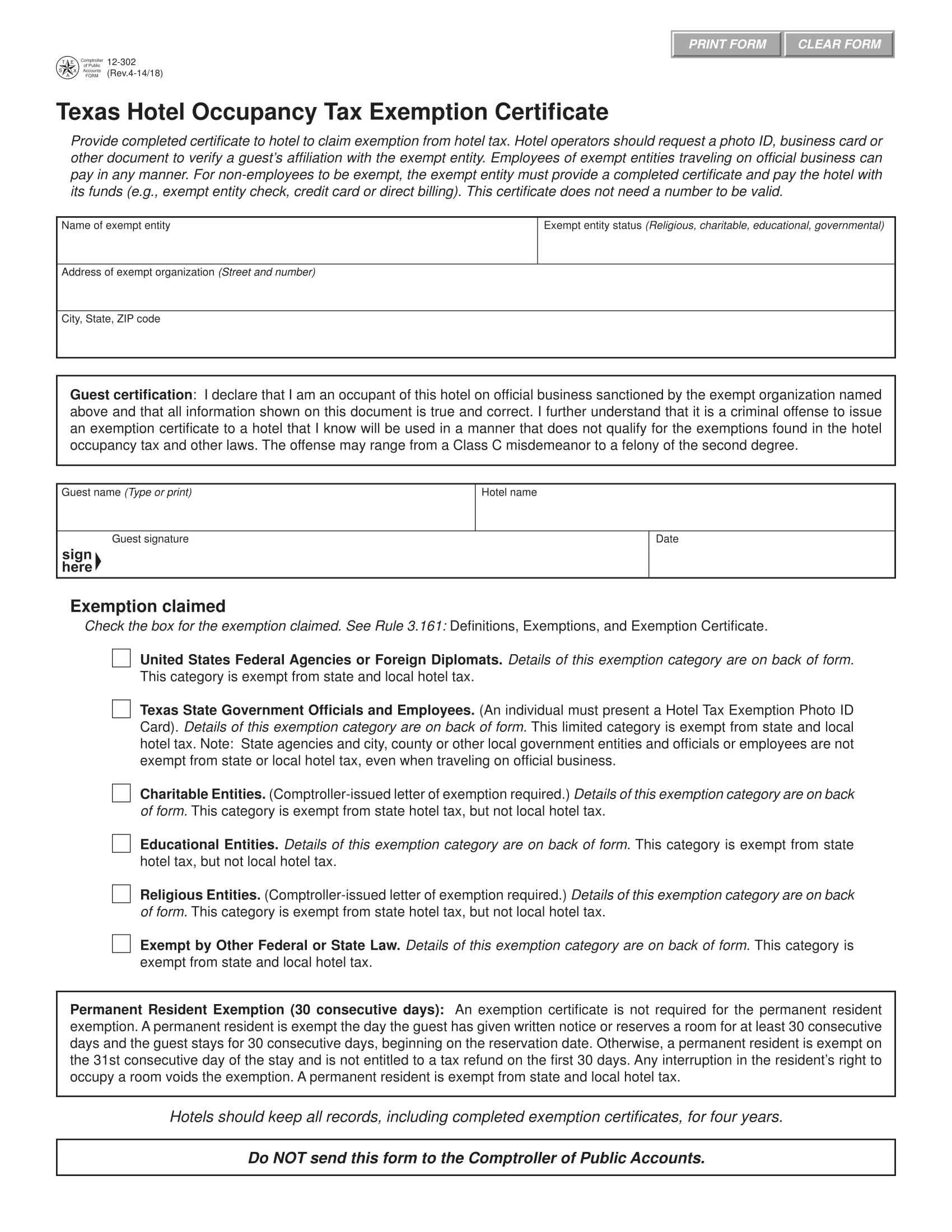

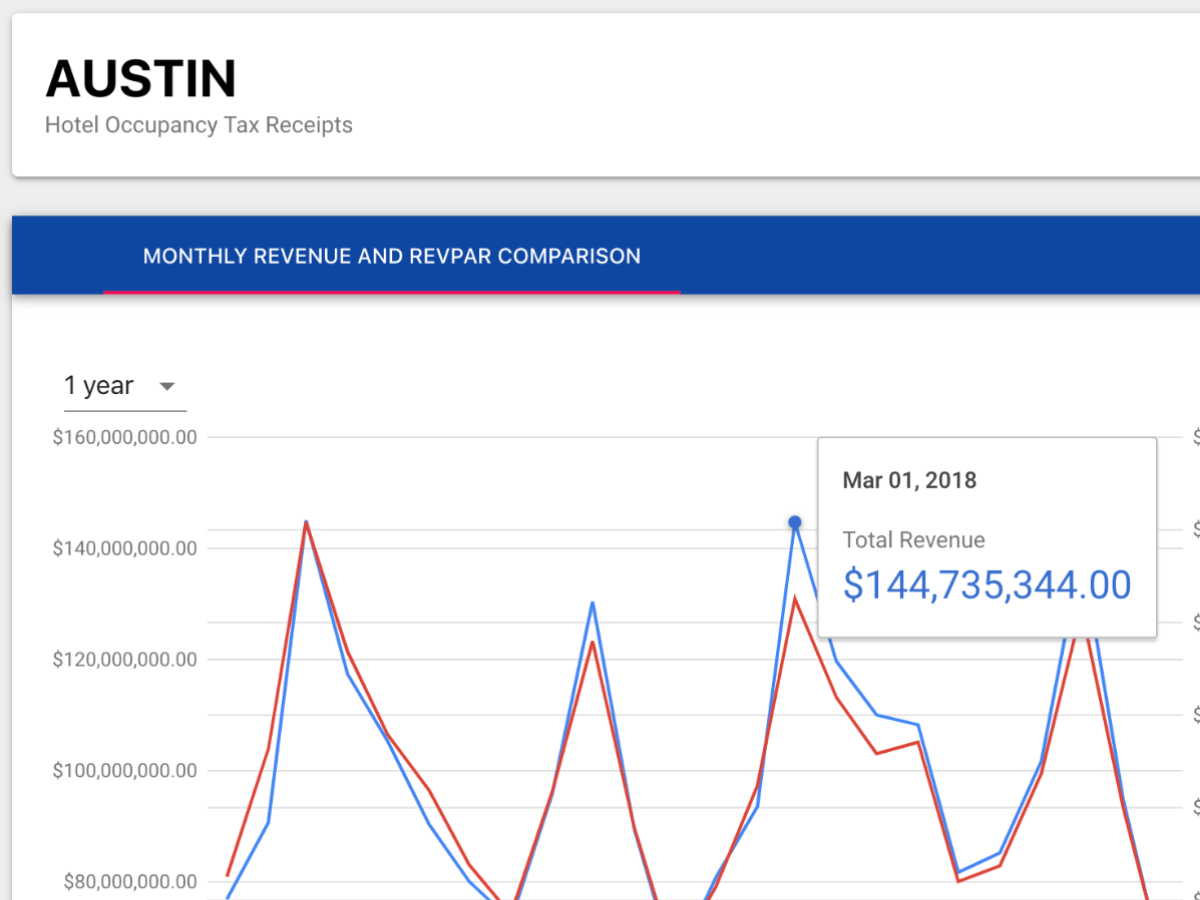

Quarterly schedule n instructions taxes on selected sales and services in new york city only report transactions for the period march 1 2019 through may 31 2019. A room remarketer such as an internet travel site is considered to be a hotel operator and must collect sales tax on the charge to its customers for hotel occupancy. Texas hotel occupancy mixed beverage tax search reintroducing the best newly improved most current searchable database of hotel occupancy tax and mixed beverage tax receipts in the state of texas. 20th day of the month following the end of each calendar month for example april 20 for march activity.

Cities and certain counties and special purpose districts are authorized to impose an additional local hotel tax that the local taxing authority collects. Llano county hotel occupancy tax quarterly receipts 2018 property name location quarter 1 quarter 2 quarter 3 quarter 4 ytd. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room. The hotel occupancy tax imposed at the same rate as sales tax applies to room rental charges for periods of less than 30 days by the same person.

In addition to hotels the tax applies to rentals of rooms apartments and houses arranged through online or third party brokers. Llano county hotel occupancy tax quarterly receipts 2017. A hotel includes an apartment hotel motel boardinghouse bed and breakfast bungalow or club whether or not meals are served. Local hotel taxes apply to sleeping rooms costing 2 or more per day.

Texas hotel data search thank you for visiting the texas comptrollers hotel data search page. All of our data is fetched straight from the texas state comptroller. Property name location quarter 1 quarter 2 quarter 3 quarter 4 ytd.