Gmu Accounting Certificate

Welcome to the school of business.

Gmu accounting certificate. The 12 credit graduate certificate in forensic accounting program provides an opportunity for students to acquire education in the emerging field of forensic accounting. The graduate certificate in forensic accounting provides an opportunity for students to acquire education in the emerging field of forensic accounting. Students with a bachelors degree in accounting can also use the certificate as a means of obtaining the necessary 150 hours of academic credit to qualify to sit for the virginia cpa exam. As such you are strongly encouraged to explore other funding options by contacting the office of student financial aid in order to find a more immediate interim solution for financing your educational plans.

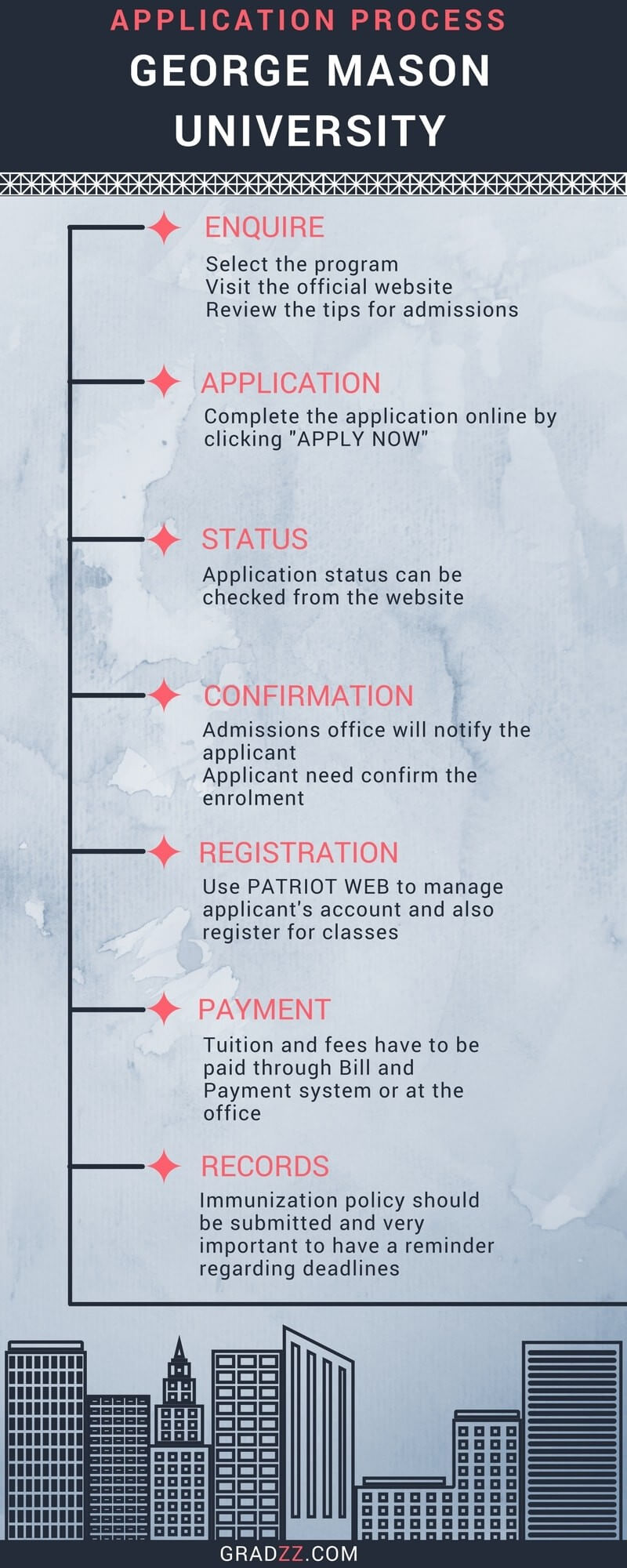

Our msa program is a launch pad into your post college career and will give you the tools you need to thrive in todays rigorous accounting industry. A maximum of 3 graduate credits taken at another institution can be transferred to the graduate certificate. Students are required to complete a minimum of 30 credits of accounting courses. The purpose of this online program is to ease your academic transition into the accounting certificate program by helping you to.

The 30 credit accounting certificate program provides an opportunity for post baccalaureate students to earn the academic credit necessary to qualify to sit for the cpa examination in virginia. The graduate certificate in government accounting program currently going through the process of becoming approved by the department of veterans affairs for veterans affairs education benefits. At least 16 required credits must be taken at mason after acceptance to the certificate program. For policies governing all graduate certificates see ap68 requirements for graduate certificates.

Understand program requirements for the certificate program select courses for your first semester identify campus resources that will assist you. The graduate certificate in accounting analytics program currently going through the process of becoming approved by the department of veterans affairs for veterans affairs education benefits. The requirement for enrollment is a bachelors degree or higher from an accredited college or university. Our masters in accounting courses emphasize the latest trends and issues in accounting business ethics and corporate governance are designed to specifically satisfy the 150 hour educational requirement adopted by a number of states including virginia for certification and licensure as a cpa.

In addition to studying financial audit and tax accounting enhance your graduate degree with certificates in government accounting forensic accounting and accounting analytics. Students are responsible for familiarization and compliance with the universitys graduate policies contained in this catalog.