Form 1120 Excel Template

We select many kinds of tax forms for you including attach and support documents individual income tax forms and estate tax forms.

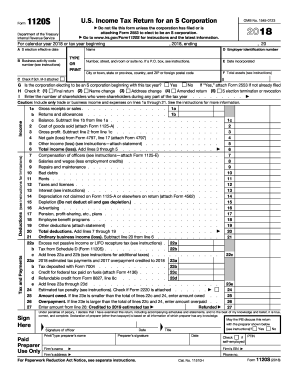

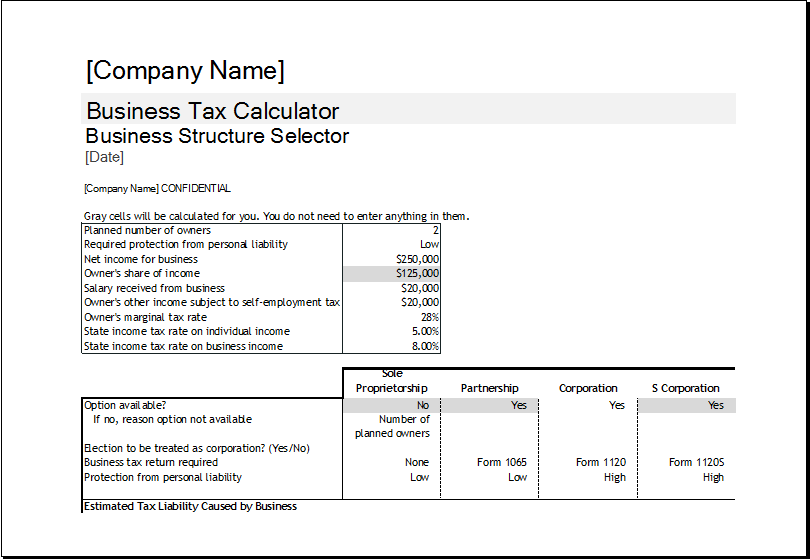

Form 1120 excel template. Free and printable tax forms are offered on this page. Using this specific tax return form helps s corps avoid the double taxation that may occur if they use a more standard type of federal return form. These are all self calculating forms. Form 1040 schedule c ez net profit from business.

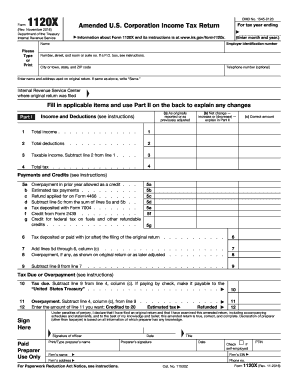

These forms were downloaded from irsgov and calculations added. The company name is brandon inc. Make sure to include this form with your return. A tax is a financial charge or other levy imposed upon a taxpayer by a state or the functional equivalent of a state to fund various public expenditures.

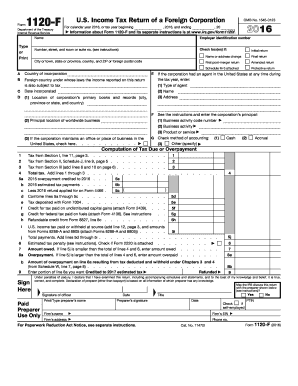

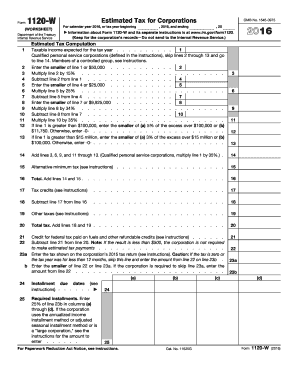

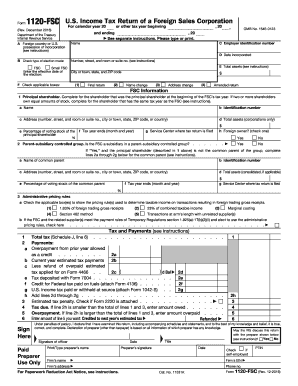

Irs form 1120 schedule h irs1120scheduleh irs form 1120 schedule m 3 irs1120schedulem3 line a4 irs form 1120 schedule o irs1120scheduleo schedule j part i line 1 irs form 1120 schedule ph irs1120scheduleph line a2 schedule j part i line 8 irs form 1120 schedule utp irs1120scheduleutp irs form 1122 irs1122 irs form 1125a irs1125a line 2 irs form 1125e irs1125e line 12. Form 1120 s is a federal income tax return designed for use specifically by s corps. Form 1120 corporate tax return b. If yes complete part i of schedule g form 1120 attach schedule g.

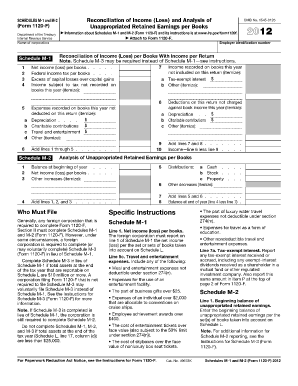

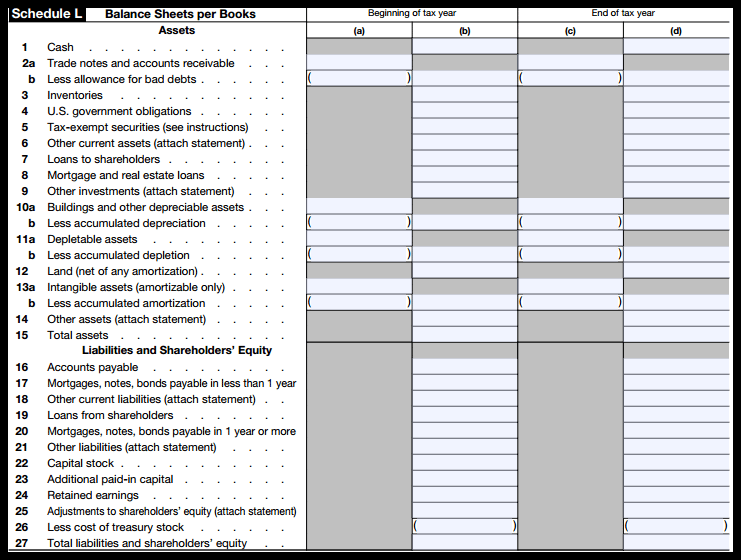

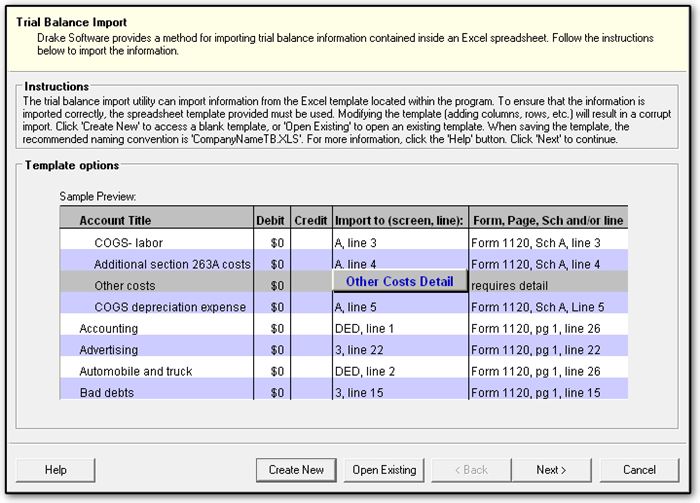

Form 1040 schedule se self employment tax. Complete the excel spreadsheet by creating the book and tax column the difference between book and tax is used for the m 1 and m 2 schedules 2. B did any individual or estate own directly 20 or more or own directly or indirectly 50 or more of the total voting power of all. Form 1120 along with schedules c d j k m 1 and m 2.

Because an s corp is a special type of business they can use a special tax form. Self calculating irs form 1120 corporate tax return. Corporation income tax return. Includes schudule c schedule j schedule k schedule l schedules m1 and m2 and form 1125 a.

Complete the following schedules. Federal income tax form 1040 excel spreadsheet income tax calculator. Complete your us federal income tax form 1040 using my microsoft excel spreadsheet income tax calculator. Schedule 1125 a cost of goods.

Form 1120 excel spreadsheets page 1 line 15 bad debt allowance for doubtful accounts beginning plus additions minus ending bad debt expense 22756 42904 26460 bad debt 39200 page 1 line 17 taxes and licenses payroll tax 61250 state income tax 73500 total 134750 page 1 line 26 other deductions general insurance 53900 utilities 70560.