Dispute Letter To Creditor Template

Transunion llc consumer dispute center po.

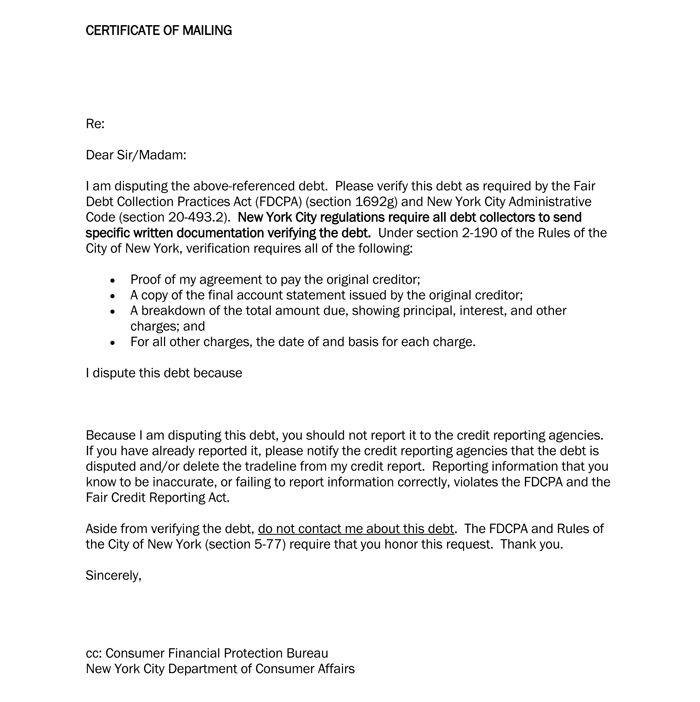

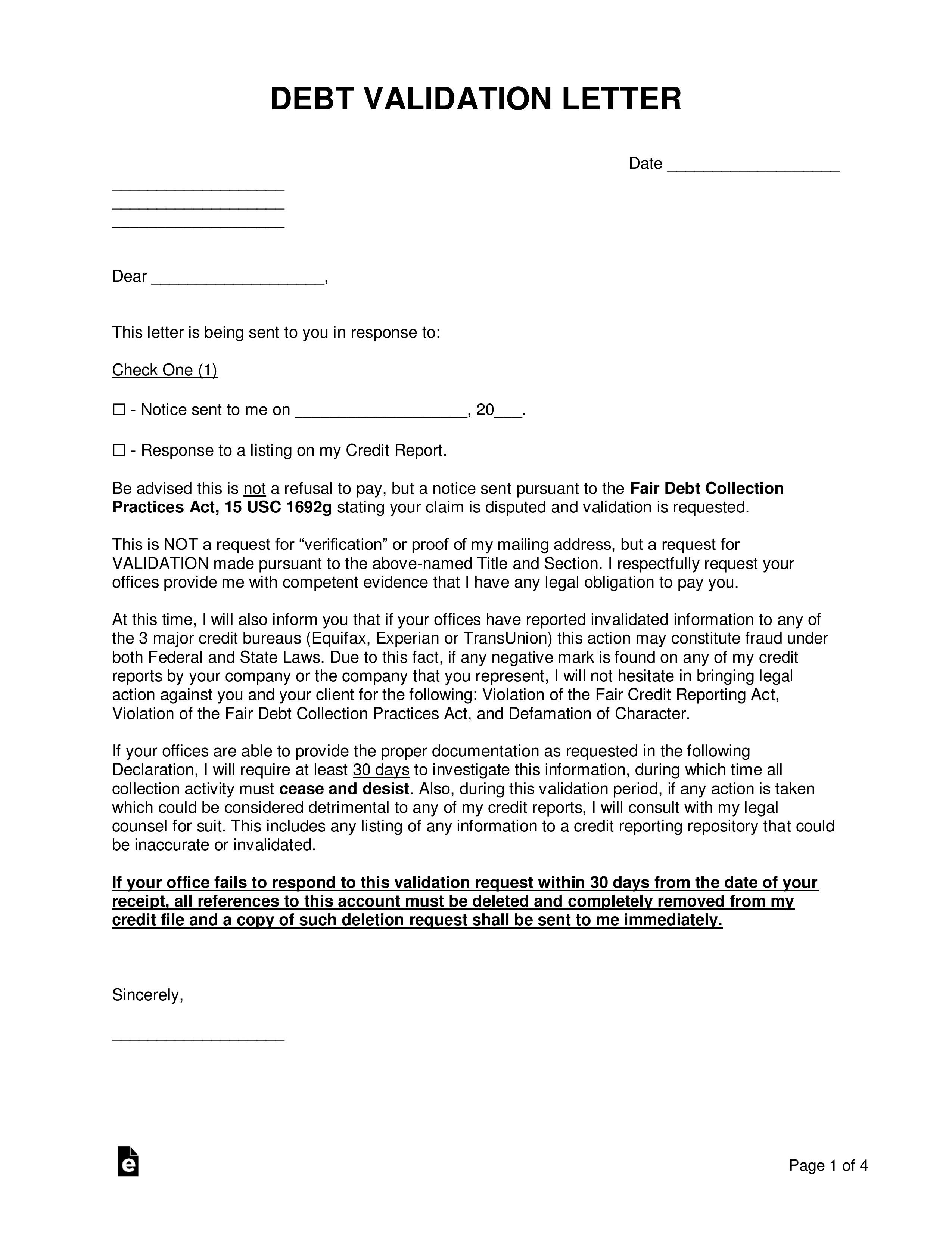

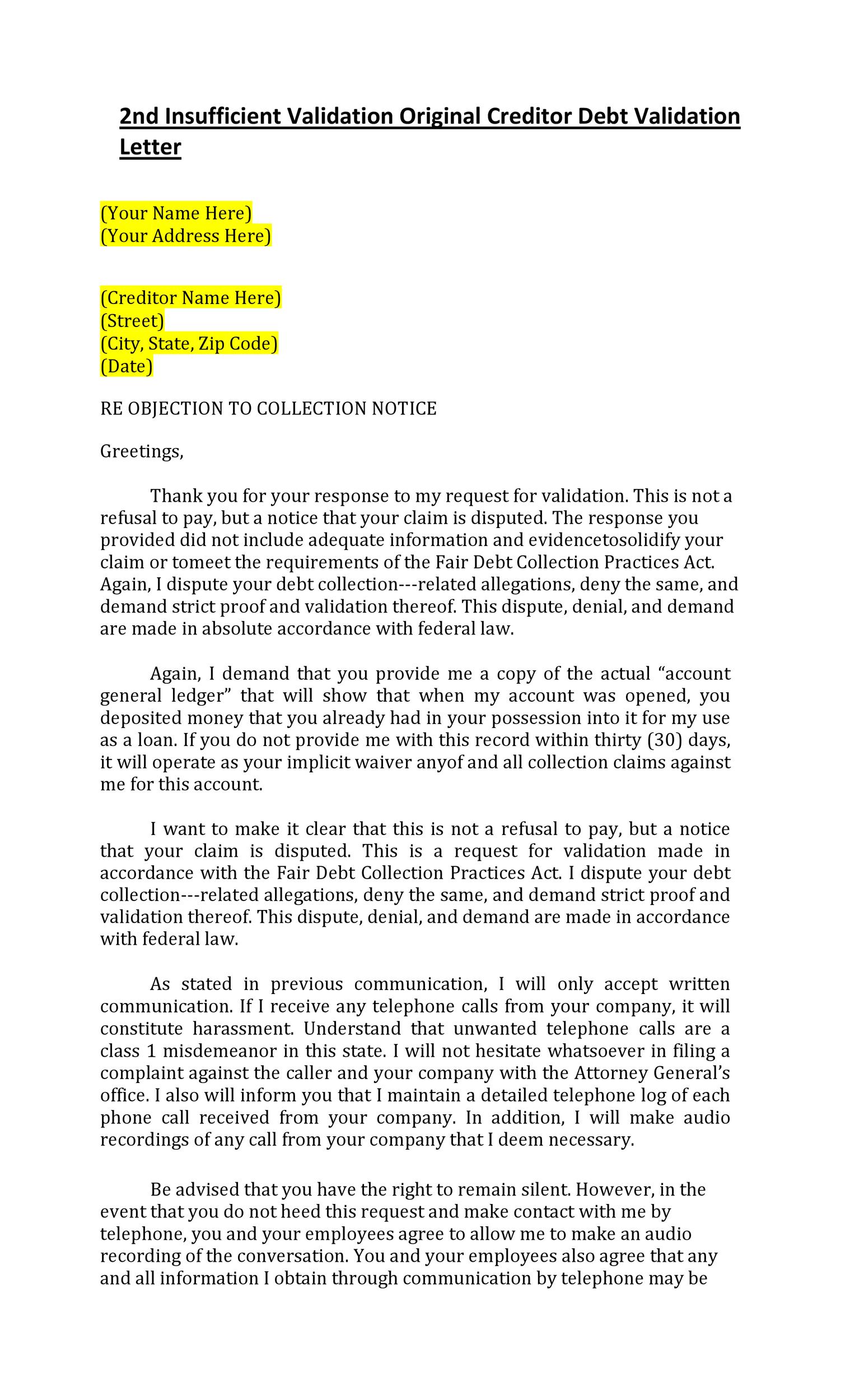

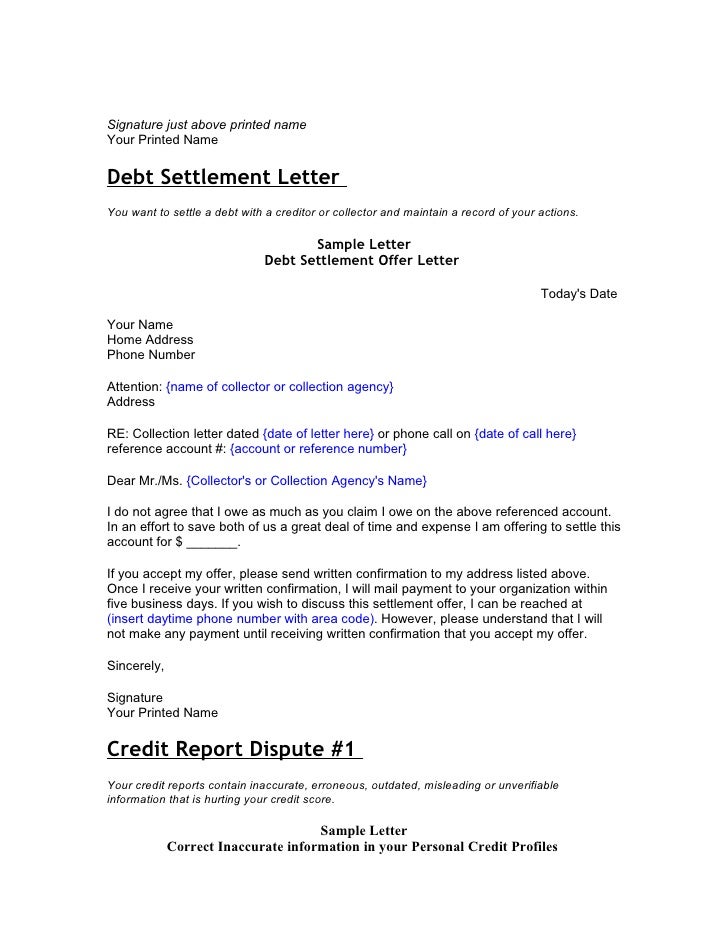

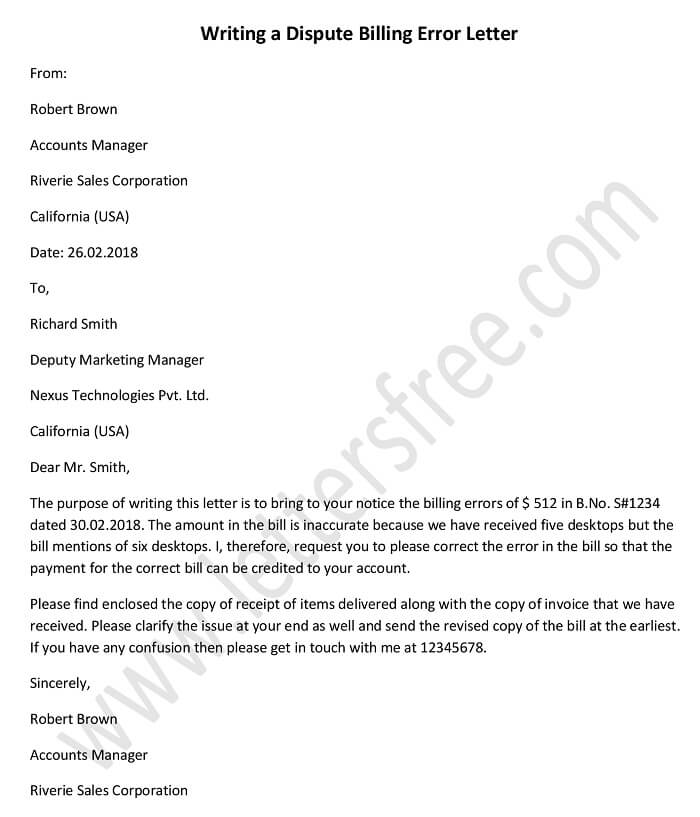

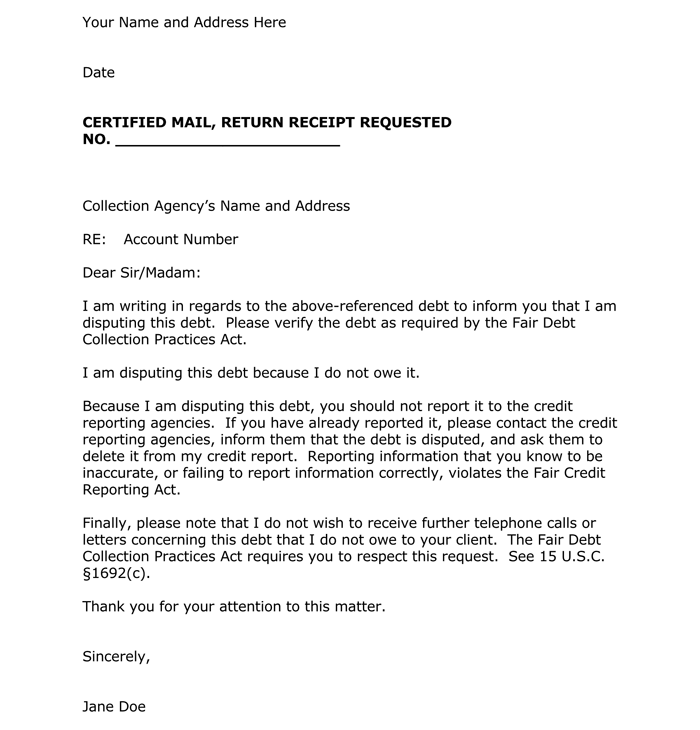

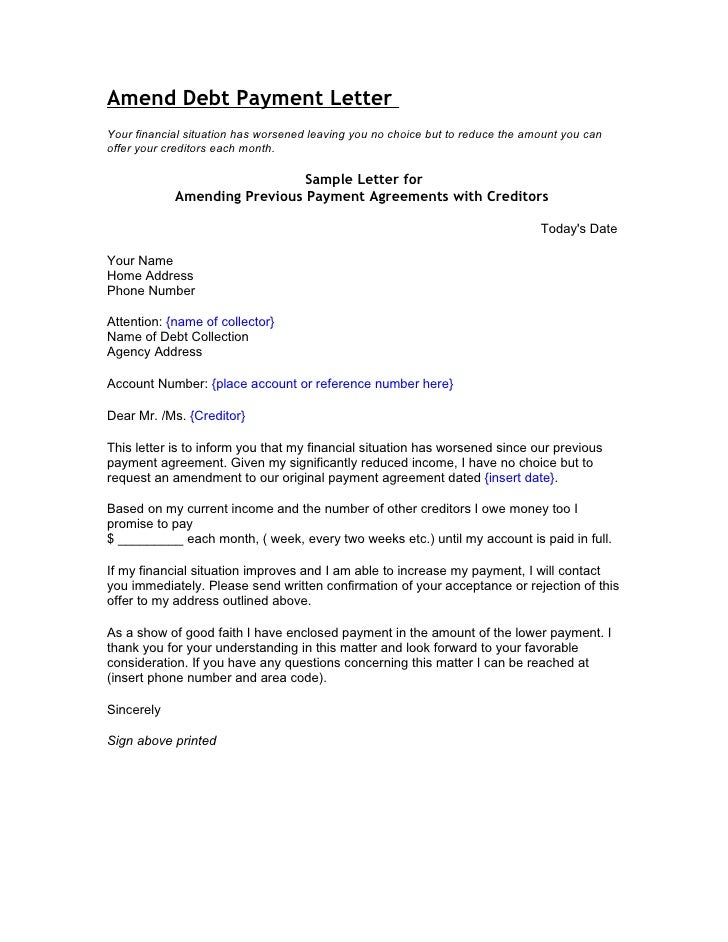

Dispute letter to creditor template. How to send a dispute letter to creditors drafting a letter to the creditor insert your address and the date. Specify any supporting documentation. Many disputes are time sensitive and a letter especially when sent via certified mail with a return receipt request gives you a timestamp to track the business response time. When you have a complaint or dispute with a creditor lender credit bureau or debt collector its best to communicate in writing.

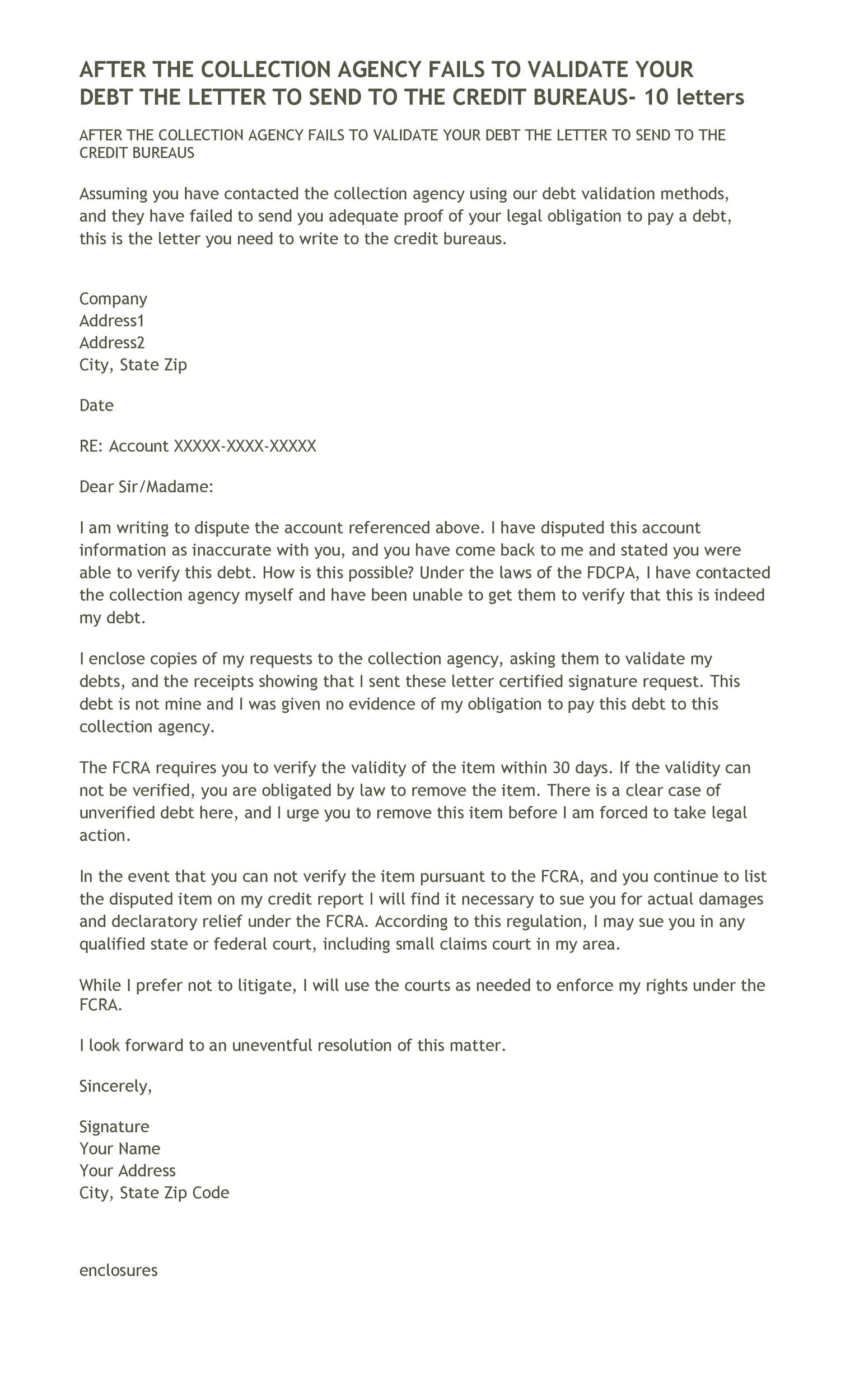

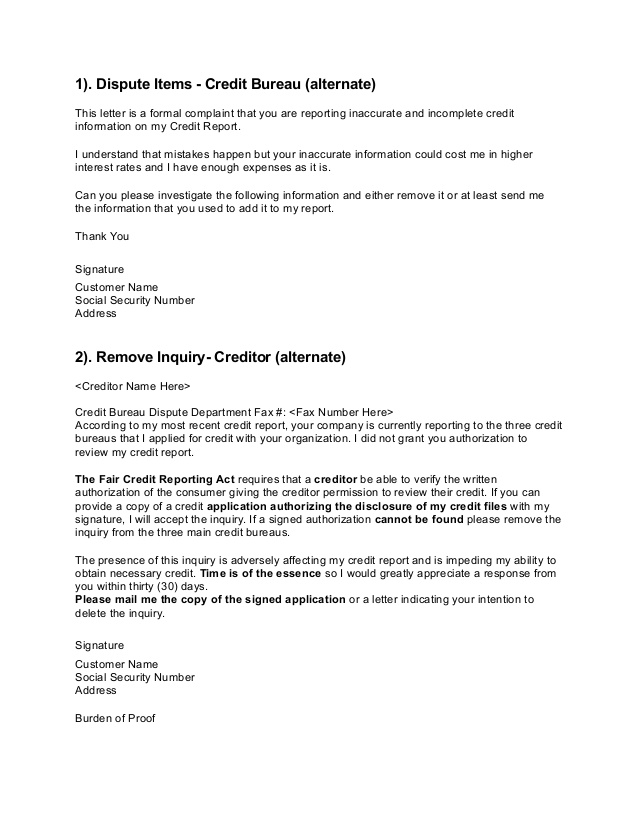

A creditor writes the dispute letter to credit bureaus as to mention the mistakes of the payment from the credit agency side. In the letter you can explain why you believe the items are inaccurate and provide any supporting documents. When you send a credit dispute letter to any of the credit bureaus by law they must investigate and resolve your dispute within 30 days. Debt dispute letter a dept dispute letter is exchanged between two parties having business with each other.

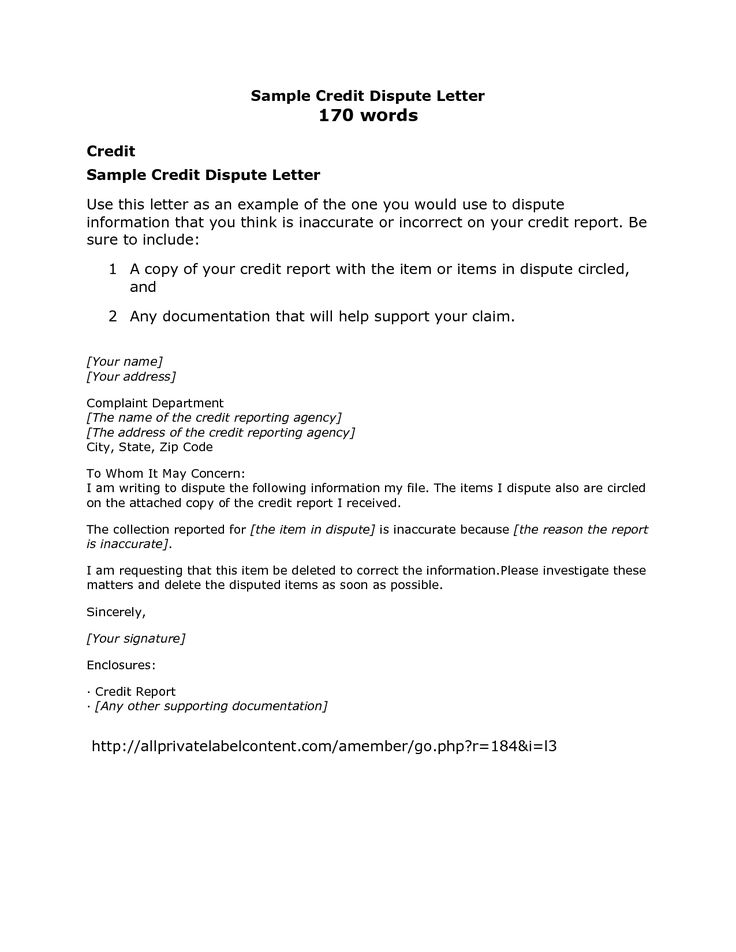

Please remember that its just an example. Its intended to give you an idea of what a credit report dispute letter should look like and what it should contain. If you send any information with the letter send copies and keep your originals. Below is a sample dispute letter disputing a credit card account.

Box 2000 chester pa 19016 4. Sample credit report dispute letter. Identify the items you dispute. You may consider return receipt requested for proof that the credit reporting company received it.

Keep a copy of the letter for your records. One of the most important powers you have as a consumer of credit is the power to utilize a credit dispute letter to dispute any items on your credit report. A credit dispute letter is a document you can send to the credit bureaus to point out inaccuracies on your credit reports and to request the removal of the errors. It can be used for an equifax experian or transunion dispute.

State why you are writing.

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)