941 Reconciliation To General Ledger Template

Reconciliations serve as a key element of a system of internal control and are required by state policy.

941 reconciliation to general ledger template. Review the general ledger accounts. Also reconcile the tax amount from form 941 line 5a to the taxable amount as recorded in a wage summary report. Number two complete the payroll reconciliation once the year end payroll is finalized and prior to sending the fourth quarter form 941 or the annual form 944 to the irs and sending the forms w 2 to employees to prevent them from having to file amendments and delay the employees ability to file their personal income tax returns. However dues paid to professional or public service organizations are deductible.

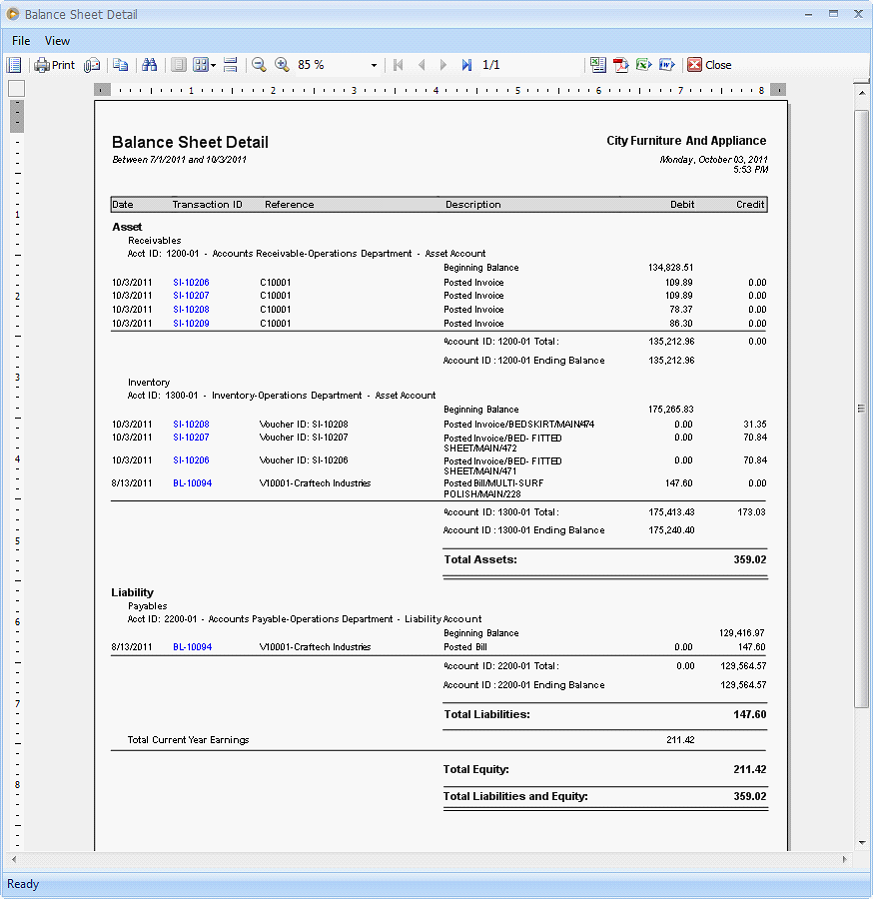

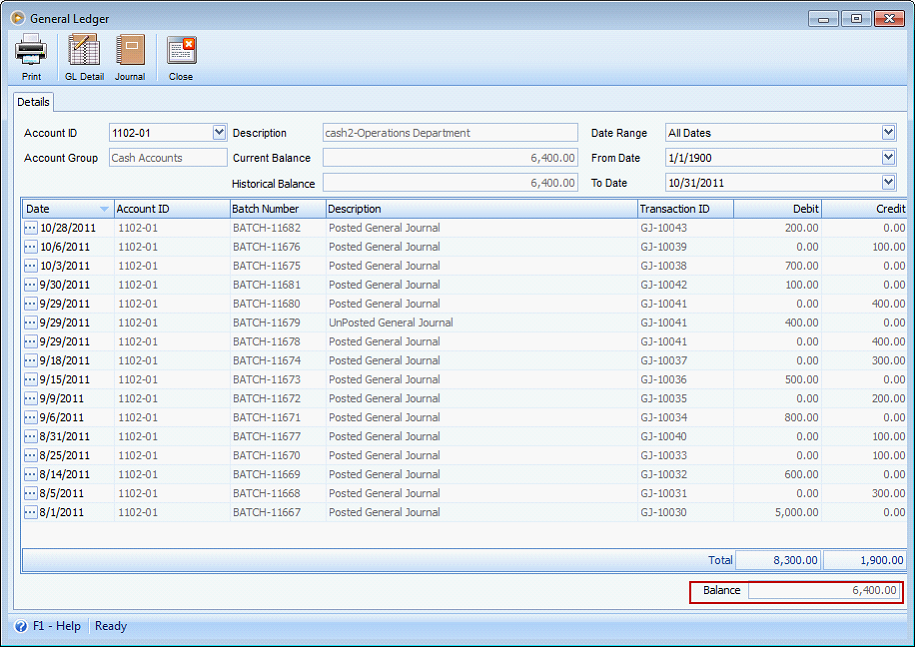

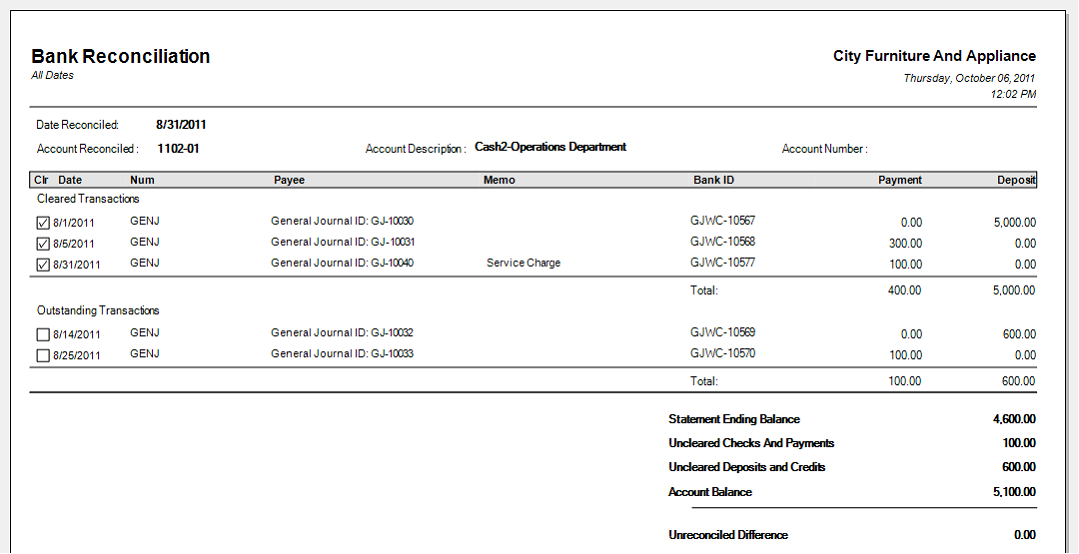

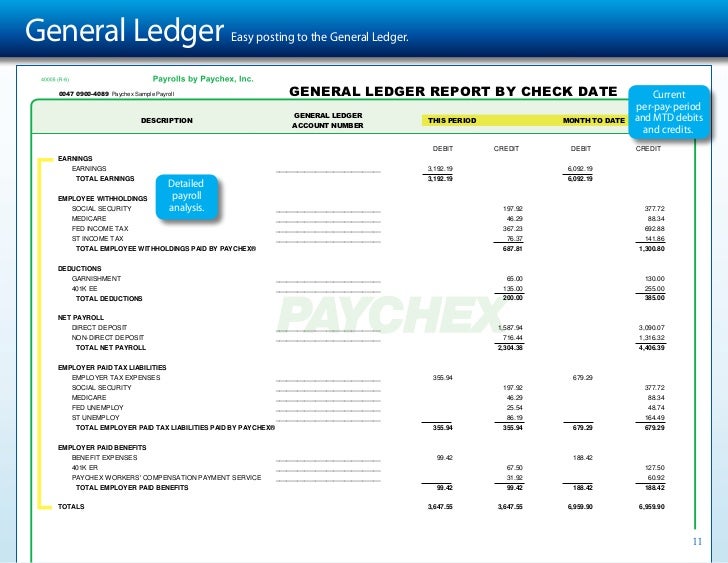

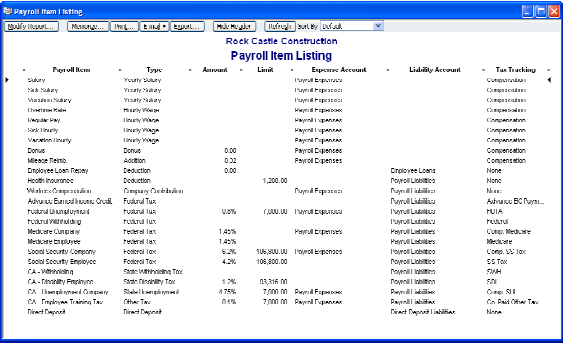

Total amounts reported on all forms 941 for the year should match the sum of the same data fields shown in w 2w 3 totals. The foundation of quality financial information is in the detail data recorded at the general ledger gl level. Forms 941 941 x w 2 and w 2c must balance for the calendar year. For social security tax withholding create a worksheet to reconcile taxable wages from form 941 line 5a to taxable wages as recorded in a wage summary report.

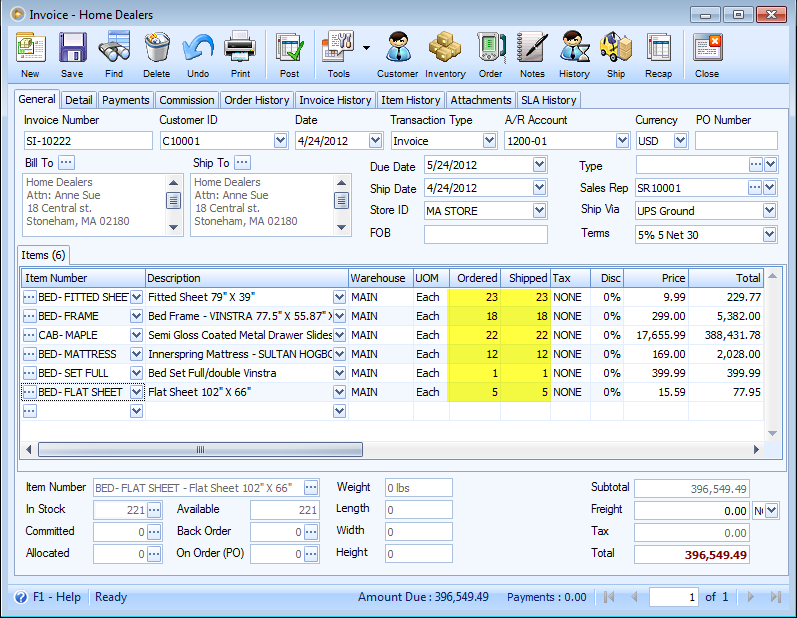

Year end reconciliation worksheet for forms 941 w 2 and w 3 annual amounts from payroll records should match the total amounts reported on all forms 941 for the year. 941 to w 2 reconciliation 2019 sample. Copies of payroll journals and employee timesheets. Because of the critical nature of reconciliations statewide accounting has been working.

As a general rule no business deduction is permitted for club dues. Schedule of legal expense and copies of related invoices. For income tax withholding create a worksheet to reconcile taxable wages from form 941 line 2 to taxable wages as recorded in a wage summary report. Fraud related payroll work papers when needed.

Please list the full cost of entertainment expenses and club dues included in your general ledger. If these forms are not in balance penalties from the irs andor ssa could result. Such denial extends to business social athletic luncheon sporting airline and hotel clubs. Use forms for the calendar year being balanced only.

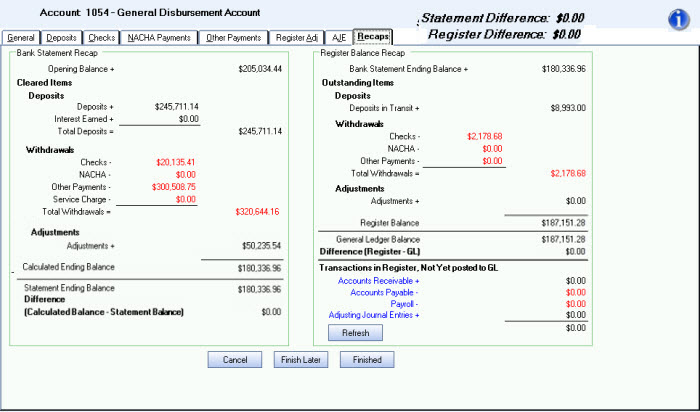

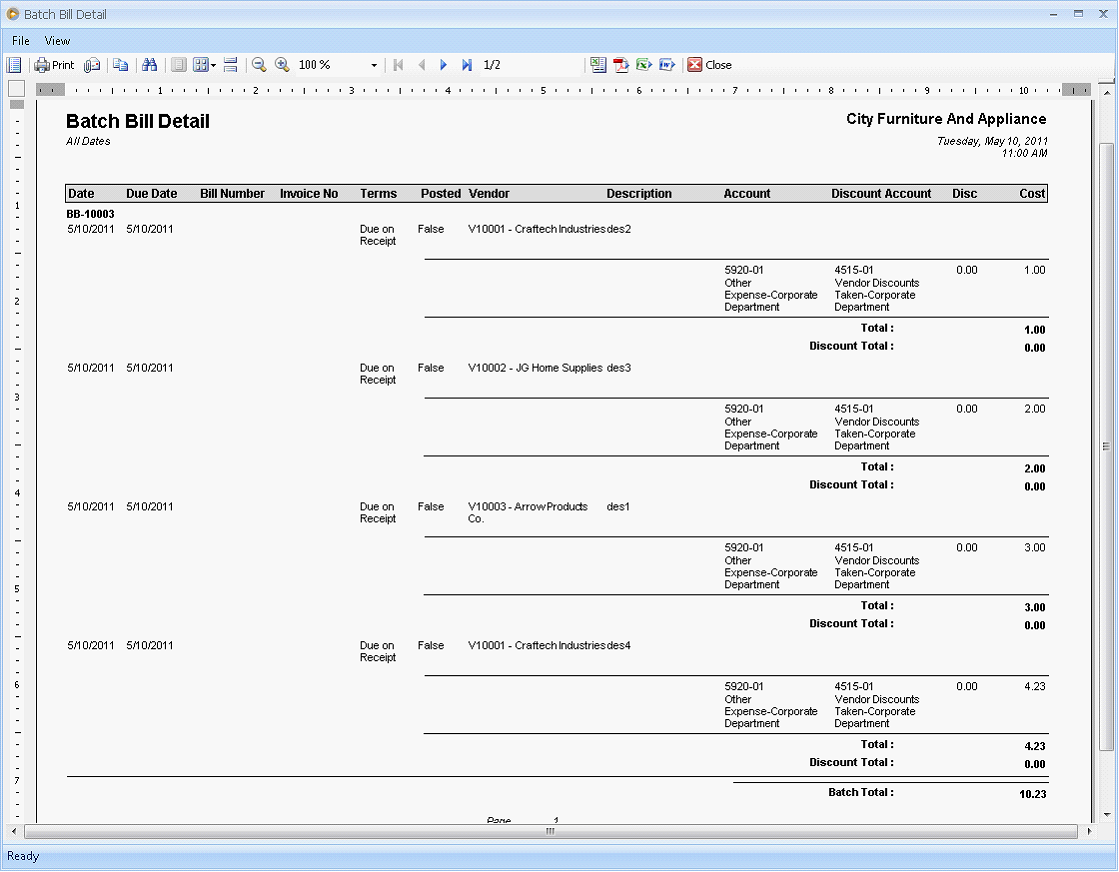

This reconciliation process is to ensure that what is recorded correctly on the payroll register for each object code is what is posted into the accounting system. And voids are entered properly. Also reconcile the tax amount from form 941 line 3 to taxable wages as recorded in. 941 to w 2 reconciliation 2018.

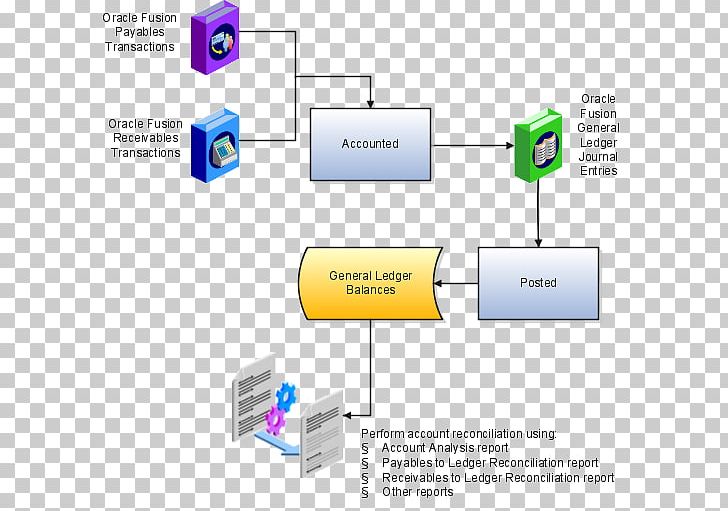

For medicare tax withholding. Schedule of functional expenses. A reconciliation of payroll in the general ledger to quarterly 941s.